Advancements in Sensor Technology

The Autonomous Cars Software Market is experiencing a notable surge in advancements in sensor technology. These innovations, including LiDAR, radar, and camera systems, enhance the perception capabilities of autonomous vehicles. As a result, the software can process vast amounts of data in real-time, improving decision-making and safety. According to recent estimates, the sensor market for autonomous vehicles is projected to reach approximately 30 billion dollars by 2026. This growth indicates a strong demand for sophisticated software solutions that can effectively integrate and utilize these sensors, thereby driving the overall market forward. The continuous evolution of sensor technology is likely to play a pivotal role in shaping the future of the Autonomous Cars Software Market Sector.

Government Initiatives and Support

Government initiatives and support are playing a crucial role in the development of the Autonomous Cars Software Market. Various countries are implementing policies and regulations that promote the testing and deployment of autonomous vehicles. For instance, funding for research projects and pilot programs is becoming increasingly common, with some governments investing millions to facilitate advancements in autonomous technology. These initiatives not only provide financial backing but also create a regulatory framework that encourages innovation. As governments recognize the potential benefits of autonomous vehicles, including reduced traffic congestion and improved road safety, the support for the Autonomous Cars Software Market Sector is likely to strengthen.

Rising Demand for Enhanced Safety Features

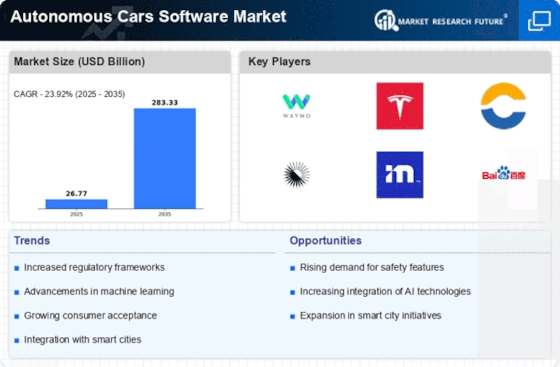

The demand for enhanced safety features is significantly influencing the Autonomous Cars Software Market. Consumers are increasingly prioritizing safety in their vehicle choices, leading to a greater emphasis on software that can provide advanced safety functionalities. Features such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control are becoming standard expectations. Market analysis indicates that the safety software segment is expected to grow at a compound annual growth rate of over 15% in the coming years. This trend underscores the necessity for software developers to innovate and integrate safety features into their autonomous systems, thereby propelling the growth of the Autonomous Cars Software Industry.

Growing Urbanization and Traffic Congestion

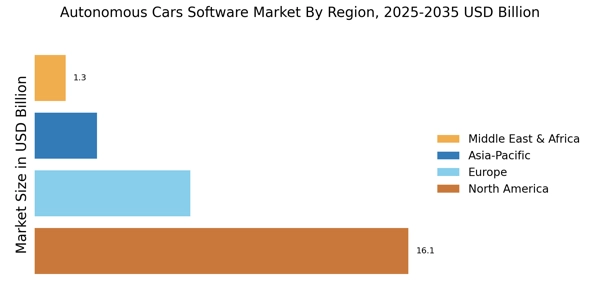

The trend of growing urbanization and traffic congestion is a significant driver for the Autonomous Cars Software Market. As urban populations continue to swell, the demand for efficient transportation solutions becomes more pressing. Autonomous vehicles, equipped with advanced software, offer the potential to alleviate traffic issues by optimizing routes and reducing travel times. Research indicates that urban areas are expected to see a 60% increase in traffic congestion by 2030, highlighting the urgent need for innovative solutions. The software that powers autonomous vehicles can play a vital role in addressing these challenges, making it a key factor in the expansion of the Autonomous Cars Software Market Landscape.

Increased Investment in Autonomous Technologies

Investment in autonomous technologies is a critical driver for the Autonomous Cars Software Market. Major automotive manufacturers and tech companies are allocating substantial resources to develop and enhance autonomous driving software. Reports suggest that investments in autonomous vehicle technology could exceed 100 billion dollars by 2030. This influx of capital not only accelerates research and development but also fosters collaboration between traditional automotive companies and tech startups. Such partnerships are essential for creating innovative software solutions that meet the demands of the evolving market. The growing financial commitment to autonomous technologies indicates a robust belief in the future of the Autonomous Cars Software Industry.