Focus on Safety and Accessibility

Safety and accessibility are paramount in the Autonomous Bus Door System Market. As cities strive to create inclusive transportation systems, the demand for door systems that cater to all passengers, including those with disabilities, is increasing. Enhanced safety features, such as automatic door sensors and emergency protocols, are becoming standard in new bus models. Recent statistics suggest that the implementation of these features could reduce accidents related to door operations by up to 30%. This focus on safety and accessibility not only meets regulatory requirements but also enhances public trust in autonomous transportation solutions.

Government Initiatives and Funding

Government initiatives play a crucial role in the growth of the Autonomous Bus Door System Market. Various governments are allocating funds to support the development and deployment of autonomous public transport solutions. These initiatives often include grants and subsidies aimed at encouraging innovation in transportation technologies. Recent reports indicate that funding for smart transportation projects has increased by approximately 25% over the past year, reflecting a commitment to modernizing public transit. Such financial support is likely to accelerate the adoption of autonomous bus door systems, making them a vital component of future urban mobility strategies.

Integration with Smart Infrastructure

The integration of autonomous bus door systems with smart infrastructure is a key driver in the Autonomous Bus Door System Market. As cities develop smart transportation networks, the need for systems that can communicate with traffic management and passenger information systems becomes essential. This integration allows for optimized routing and scheduling, enhancing the overall efficiency of public transport. Market analysis suggests that by 2026, nearly 40% of new bus systems will feature integrated autonomous door technologies. This trend indicates a shift towards a more interconnected transportation ecosystem, where autonomous systems work in harmony with existing infrastructure.

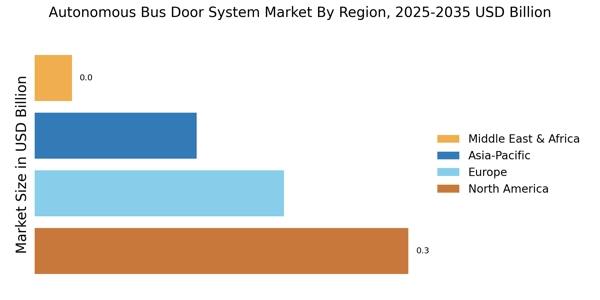

Rising Demand for Public Transportation

The Autonomous Bus Door System Market is witnessing a notable increase in demand for public transportation solutions. As urban populations grow, cities are investing in efficient and reliable public transit systems. The need for autonomous buses equipped with advanced door systems is becoming more pronounced, as these systems facilitate smoother boarding and alighting processes. Market data indicates that regions with high urban density are likely to see a 20% increase in autonomous bus deployments by 2027. This trend underscores the importance of integrating autonomous door systems to enhance the overall efficiency and appeal of public transportation.

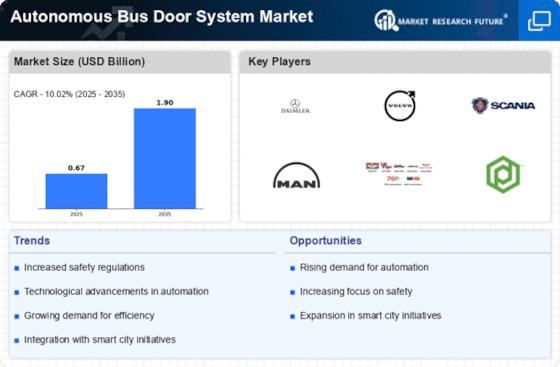

Technological Advancements in Automation

The Autonomous Bus Door System Market is experiencing a surge in technological advancements that enhance operational efficiency and safety. Innovations in sensor technology, artificial intelligence, and machine learning are driving the development of more sophisticated door systems. These advancements allow for real-time monitoring and adaptive responses to passenger needs, thereby improving user experience. According to recent data, the integration of advanced automation technologies is projected to increase the market size significantly, with estimates suggesting a growth rate of over 15% annually. This trend indicates a strong demand for systems that not only automate door operations but also ensure safety and reliability in various environmental conditions.