Rising Demand for Electric Vehicles

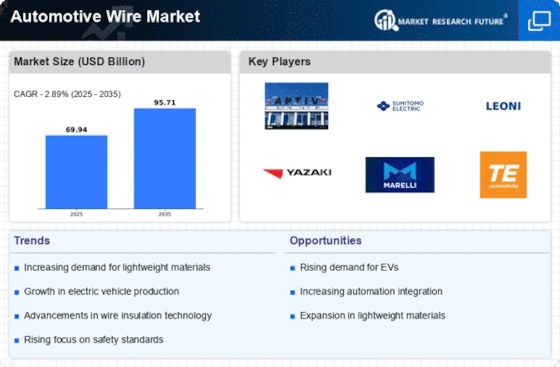

The increasing adoption of electric vehicles (EVs) is a primary driver for the Automotive Wire Market. As manufacturers pivot towards EV production, the demand for specialized wiring solutions that can handle higher voltages and currents is surging. In 2025, it is estimated that the EV market will account for approximately 30% of total vehicle sales, necessitating advanced wiring systems that ensure safety and efficiency. This shift not only influences the types of materials used in automotive wiring but also propels innovation in wire design and insulation technologies. Consequently, the Automotive Wire Market is likely to experience substantial growth as automakers seek to meet the evolving requirements of electric drivetrains.

Growth of the Automotive Aftermarket

The automotive aftermarket sector is experiencing robust growth, which serves as a significant driver for the Automotive Wire Market. As vehicle ownership rates rise, the demand for replacement parts, including automotive wiring, is expected to increase. In 2025, the aftermarket segment is projected to account for nearly 40% of total automotive sales, highlighting the importance of reliable wiring solutions for vehicle maintenance and repair. This trend encourages manufacturers to diversify their product offerings and enhance the quality of automotive wiring to meet the needs of both consumers and repair shops. Consequently, the Automotive Wire Market is likely to benefit from this expanding aftermarket landscape.

Sustainability and Eco-Friendly Practices

The growing emphasis on sustainability is reshaping the Automotive Wire Market, as manufacturers are increasingly adopting eco-friendly practices. The automotive sector is under pressure to reduce its carbon footprint, prompting a shift towards sustainable materials in wire production. By 2025, it is anticipated that the demand for recyclable and biodegradable wiring solutions will rise significantly, driven by consumer preferences for environmentally responsible products. This trend not only aligns with global sustainability goals but also encourages innovation in the development of new materials and manufacturing processes. As a result, the Automotive Wire Market is likely to evolve, focusing on sustainable practices that meet both regulatory requirements and consumer expectations.

Regulatory Compliance and Safety Standards

Stringent regulatory frameworks and safety standards are increasingly influencing the Automotive Wire Market. Governments worldwide are implementing regulations that mandate the use of high-quality materials and safety features in automotive wiring. For instance, the introduction of new safety protocols in 2025 is expected to drive demand for wiring solutions that meet these enhanced standards. Compliance with these regulations not only ensures vehicle safety but also promotes the use of environmentally friendly materials in wire production. As a result, manufacturers in the Automotive Wire Market are likely to invest in research and development to create compliant products that align with regulatory expectations.

Technological Advancements in Automotive Wiring

Technological innovations are reshaping the Automotive Wire Market, particularly with the integration of smart technologies in vehicles. The rise of advanced driver-assistance systems (ADAS) and connected car features necessitates sophisticated wiring solutions that can support high data transmission rates. As of 2025, the market for automotive wiring harnesses is projected to reach USD 20 billion, driven by the need for enhanced connectivity and safety features. These advancements compel manufacturers to develop lightweight, durable, and flexible wiring systems that can accommodate the growing complexity of modern vehicles. Thus, the Automotive Wire Market is poised for growth as it adapts to these technological demands.