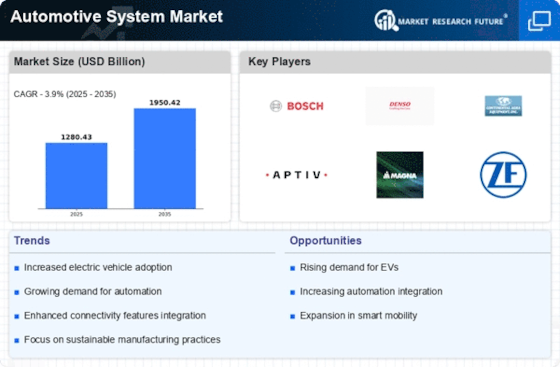

Growing Demand for Electric Vehicles

The growing demand for electric vehicles (EVs) is reshaping the Automotive System Market. As consumers become more environmentally conscious, the shift towards EVs is accelerating. In 2025, it is estimated that electric vehicles will account for over 25% of total vehicle sales, driven by advancements in battery technology and government incentives. This transition is not merely a trend; it represents a fundamental change in consumer preferences and regulatory frameworks aimed at reducing carbon emissions. Automakers are responding by investing in electric powertrains and associated systems, which are crucial for the performance and efficiency of EVs. The Automotive System Market is thus experiencing a surge in demand for components such as electric motors, battery management systems, and charging infrastructure, indicating a robust growth trajectory in the coming years.

Increased Focus on Vehicle Connectivity

The increased focus on vehicle connectivity is a significant driver in the Automotive System Market. As vehicles become more integrated with digital technologies, the demand for connected car features is surging. By 2025, it is projected that over 70% of new vehicles will be equipped with some form of connectivity, enabling features such as real-time traffic updates, remote diagnostics, and over-the-air software updates. This trend is largely fueled by consumer expectations for seamless integration with smartphones and other devices. Furthermore, automakers are leveraging connectivity to enhance user experience and gather valuable data for improving vehicle performance. The Automotive System Market is thus witnessing a transformation, as manufacturers prioritize the development of connected systems that not only enhance functionality but also contribute to the overall safety and efficiency of vehicles.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Automotive System Market. Governments worldwide are implementing stringent regulations aimed at enhancing vehicle safety and reducing emissions. As of 2025, it is anticipated that compliance with these regulations will drive a substantial portion of the market, with investments in safety technologies expected to exceed 20 billion USD. Automakers are compelled to adapt their systems to meet these evolving standards, which include requirements for crashworthiness, emissions control, and fuel efficiency. This regulatory landscape is fostering innovation within the Automotive System Market, as manufacturers seek to develop advanced technologies that not only comply with regulations but also provide competitive advantages. Consequently, the focus on safety and compliance is likely to shape product development and market strategies in the automotive sector.

Emergence of Autonomous Driving Technologies

The emergence of autonomous driving technologies is a transformative driver in the Automotive System Market. As advancements in artificial intelligence and sensor technologies progress, the potential for fully autonomous vehicles is becoming more tangible. By 2025, it is projected that the market for autonomous driving systems will reach approximately 40 billion USD, reflecting a growing interest from both consumers and manufacturers. This shift is driven by the promise of enhanced safety, reduced traffic congestion, and improved mobility for individuals unable to drive. Automakers are investing heavily in research and development to create reliable autonomous systems, which are expected to integrate seamlessly with existing automotive technologies. The Automotive System Market is thus on the brink of a revolution, as the development of autonomous vehicles could redefine transportation and mobility in the years to come.

Integration of Advanced Driver Assistance Systems

The integration of Advanced Driver Assistance Systems (ADAS) is a pivotal driver in the Automotive System Market. These systems enhance vehicle safety and improve the driving experience by providing features such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking. As of 2025, the market for ADAS is projected to reach approximately 30 billion USD, reflecting a compound annual growth rate of around 10%. This growth is largely attributed to increasing consumer demand for safety features and the regulatory push for enhanced vehicle safety standards. Consequently, manufacturers are investing heavily in the development of these systems, which are becoming standard in many new vehicles. The Automotive System Market is thus witnessing a significant shift towards the incorporation of these advanced technologies, which not only improve safety but also pave the way for future autonomous driving capabilities.