Increasing Vehicle Production

The automotive industry is witnessing a robust increase in vehicle production, which directly influences the Automotive Springs and Dampers Market. As manufacturers ramp up production to meet consumer demand, the need for high-quality springs and dampers becomes paramount. In 2025, the production of passenger vehicles is projected to reach approximately 80 million units, indicating a significant rise from previous years. This surge necessitates the incorporation of advanced suspension systems, which rely heavily on effective springs and dampers. Consequently, the Automotive Springs and Dampers Market is likely to experience substantial growth as automakers seek to enhance vehicle performance and comfort through improved suspension technologies.

Growing Focus on Vehicle Safety

The emphasis on vehicle safety is becoming increasingly pronounced, influencing the Automotive Springs and Dampers Market. Regulatory bodies are implementing stringent safety standards that necessitate the incorporation of advanced suspension systems to enhance vehicle stability and control. As a result, manufacturers are investing in high-quality springs and dampers that can withstand rigorous testing and provide superior performance under various driving conditions. This trend is expected to drive the market forward, as automakers prioritize safety features in their designs, thereby creating a favorable environment for the Automotive Springs and Dampers Market.

Expansion of Aftermarket Services

The expansion of aftermarket services is significantly impacting the Automotive Springs and Dampers Market. As vehicle owners increasingly seek to enhance their vehicles' performance and comfort, the demand for replacement and upgraded springs and dampers is on the rise. In 2025, the aftermarket segment is projected to account for a substantial share of the overall market, driven by consumer preferences for personalized vehicle modifications. This trend not only boosts sales for manufacturers but also encourages innovation in the Automotive Springs and Dampers Market, as companies strive to meet the evolving needs of consumers.

Rising Demand for Electric Vehicles

The transition towards electric vehicles (EVs) is reshaping the Automotive Springs and Dampers Market. As EV adoption accelerates, manufacturers are increasingly focusing on developing specialized suspension systems that cater to the unique weight distribution and performance characteristics of electric drivetrains. In 2025, it is estimated that EV sales will account for over 25% of total vehicle sales, creating a burgeoning market for innovative springs and dampers designed for these vehicles. This shift not only enhances driving dynamics but also contributes to overall vehicle efficiency, thereby driving demand within the Automotive Springs and Dampers Market.

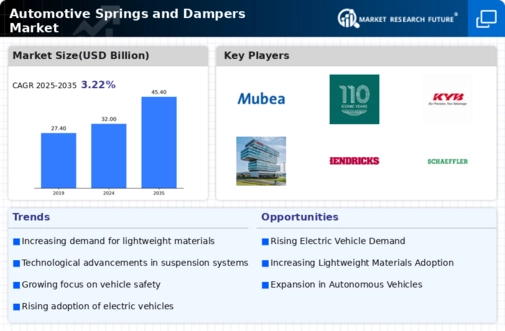

Technological Advancements in Suspension Systems

Technological innovations are playing a crucial role in shaping the Automotive Springs and Dampers Market. The integration of advanced materials and manufacturing techniques has led to the development of high-performance springs and dampers that offer improved durability and efficiency. For instance, the introduction of adaptive suspension systems, which adjust damping characteristics in real-time, is gaining traction among consumers seeking enhanced ride quality. As automakers increasingly adopt these technologies, the Automotive Springs and Dampers Market is poised for growth, with a projected increase in market value expected to reach several billion dollars by 2026.