Expansion of Aftermarket Services

The Automotive Spring Market is benefiting from the expansion of aftermarket services, as vehicle owners increasingly seek to upgrade or replace suspension components. This trend is fueled by a growing awareness of the importance of vehicle performance and safety. Aftermarket sales of automotive springs are projected to grow significantly, driven by the increasing age of vehicles on the road and the desire for enhanced driving experiences. Data suggests that the aftermarket segment could represent nearly 40% of total automotive parts sales by 2026. Consequently, the Automotive Spring Market is likely to see a surge in demand for high-quality replacement springs, prompting manufacturers to diversify their product lines.

Growth of Electric Vehicle Market

The rise of electric vehicles (EVs) is significantly influencing the Automotive Spring Market, as these vehicles require specialized suspension systems to accommodate their unique weight distribution and performance characteristics. The increasing adoption of EVs is expected to drive demand for innovative spring solutions that enhance ride comfort and handling. Market analysis suggests that the EV segment could account for over 30% of new vehicle sales by 2030, creating substantial opportunities for spring manufacturers. This shift necessitates a reevaluation of existing spring designs, prompting the Automotive Spring Market to innovate and adapt to the specific needs of electric vehicles.

Rising Demand for Lightweight Materials

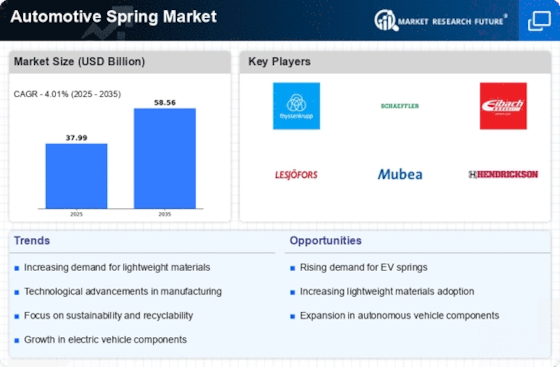

The Automotive Spring Market is experiencing a notable shift towards lightweight materials, driven by the need for improved fuel efficiency and reduced emissions. Manufacturers are increasingly adopting materials such as high-strength steel and composite materials to produce springs that are lighter yet durable. This trend aligns with regulatory pressures aimed at lowering carbon footprints, as lighter vehicles consume less fuel. According to recent data, the demand for lightweight automotive components is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. Consequently, the Automotive Spring Market is likely to see a surge in innovation as companies strive to meet these evolving standards.

Increasing Focus on Vehicle Safety Standards

The Automotive Spring Market is witnessing heightened attention to vehicle safety standards, which is driving demand for high-performance springs. Regulatory bodies are implementing stricter safety regulations, necessitating the use of advanced spring technologies that enhance vehicle stability and crashworthiness. Manufacturers are compelled to invest in research and development to create springs that meet these evolving safety requirements. Recent statistics indicate that The Automotive Spring Market is projected to grow at a CAGR of 7% through 2028, which will likely bolster the Automotive Spring Market as companies strive to comply with these standards and enhance their product offerings.

Technological Innovations in Spring Manufacturing

Technological advancements are reshaping the Automotive Spring Market, with innovations in manufacturing processes enhancing product quality and efficiency. Techniques such as 3D printing and advanced heat treatment are being integrated into production lines, allowing for the creation of springs with complex geometries and improved performance characteristics. These innovations not only reduce production costs but also enable manufacturers to respond swiftly to market demands. Data indicates that the adoption of advanced manufacturing technologies could lead to a 20% reduction in production time, thereby increasing the competitiveness of companies within the Automotive Spring Market. As a result, firms that embrace these technologies may gain a significant edge.

.png)