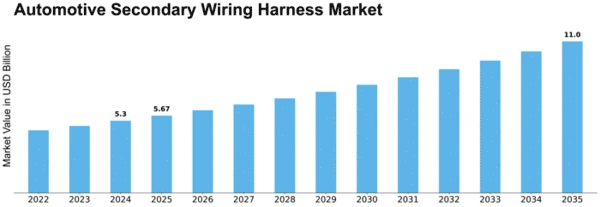

Automotive Secondary Wiring Harness Size

Automotive Secondary Wiring Harness Market Growth Projections and Opportunities

The global automotive wiring harness market is anticipated to grow at a rate of 6.35% during the forecast period from 2017 to 2023. In 2016, Asia Pacific dominated the market, holding a substantial share of 45.22%, followed by Europe with 25.33% and North America with 22.01%. The market is categorized based on applications, including Engine, HVAC, Body, Chassis, Sensors, and Others. The Engine segment held the largest market share.

When it comes to components, the market is divided into wires, connectors, and terminals. Among these, wires had the most significant market share in 2016, accounting for 70.66% in the automotive wiring harness market.

The automotive wiring harness market is witnessing substantial growth globally, driven by factors such as technological advancements, increasing vehicle production, and rising demand for electric and hybrid vehicles. The Asia Pacific region, particularly China and India, plays a crucial role in the market's growth due to the booming automotive industry in these countries.

The Engine segment holds a prominent position in the automotive wiring harness market. This is because the engine is a critical part of a vehicle, and wiring harnesses are essential components for transmitting electrical signals and power to various engine parts. As the demand for fuel-efficient and high-performance vehicles continues to rise, the need for sophisticated wiring harness systems in the engine becomes more pronounced.

In terms of components, wires are integral to the automotive wiring harness. They form the backbone of the entire system, facilitating the transmission of electrical signals between different components of a vehicle. The increasing complexity of automotive systems and the growing emphasis on safety and connectivity contribute to the rising demand for high-quality wires in wiring harnesses.

The market is witnessing continuous advancements in technology, leading to the development of lightweight and efficient wiring harness systems. These innovations contribute to better fuel efficiency and overall vehicle performance. Moreover, the growing popularity of electric and hybrid vehicles, which rely heavily on advanced wiring systems, is a significant driver for the market.

Considering the regional landscape, Asia Pacific is a powerhouse in the automotive wiring harness market. The region's dominance is attributed to the substantial growth in vehicle production, particularly in countries like China and India. The increasing consumer demand for automobiles and the expansion of manufacturing facilities by key automotive players further fuel the market's growth in Asia Pacific.

Europe and North America also play crucial roles in the global automotive wiring harness market. The stringent regulations pertaining to vehicle safety and emissions in these regions drive the adoption of advanced wiring harness systems. Additionally, the presence of leading automotive manufacturers and the continuous focus on research and development contribute to the market's growth in Europe and North America.

In conclusion, the global automotive wiring harness market is on a robust growth trajectory, driven by technological advancements, increasing vehicle production, and the growing popularity of electric and hybrid vehicles. The market's landscape is shaped by the dynamic automotive industry, with Asia Pacific emerging as a key player due to its thriving automotive sector. As the demand for sophisticated wiring systems continues to rise, the market is poised for further expansion in the coming years.

Leave a Comment