Increasing Vehicle Safety Regulations

The Global Automotive Seat Belt Pretensioner Market Industry is experiencing growth due to stringent vehicle safety regulations imposed by governments worldwide. Regulatory bodies are mandating the inclusion of advanced safety features in vehicles, including pretensioners, which enhance seat belt effectiveness during collisions. For instance, the European Union has implemented regulations that require all new vehicles to be equipped with advanced safety systems. This regulatory push is expected to contribute significantly to the market, as manufacturers strive to comply with these standards, thereby increasing the demand for seat belt pretensioners.

Projected Market Growth and Economic Factors

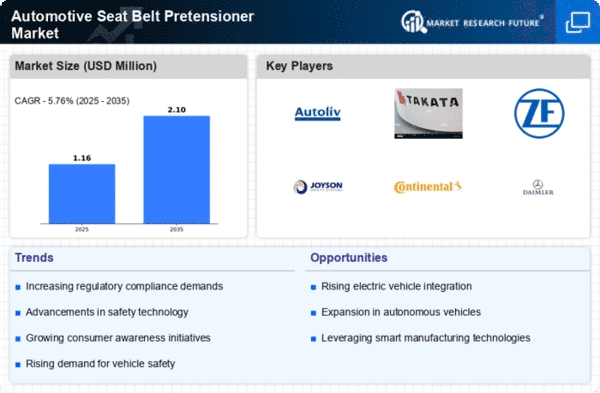

The Global Automotive Seat Belt Pretensioner Market Industry is poised for substantial growth, with projections indicating a market value of 3500 USD Million in 2024 and an anticipated increase to 6200 USD Million by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.34% from 2025 to 2035. Economic factors, including rising disposable incomes and increased vehicle ownership, are likely to drive this growth. As consumers invest in new vehicles, the demand for advanced safety features, including seat belt pretensioners, is expected to rise, further propelling the market.

Rising Consumer Awareness of Safety Features

Consumer awareness regarding vehicle safety features is on the rise, driving the Global Automotive Seat Belt Pretensioner Market Industry forward. As individuals become more informed about the benefits of advanced safety technologies, they are increasingly prioritizing vehicles equipped with such features. This trend is particularly evident in regions with high vehicle ownership rates, where consumers are willing to invest in safety enhancements. The growing emphasis on personal safety is likely to propel the demand for seat belt pretensioners, as consumers seek vehicles that offer superior protection during accidents.

Technological Advancements in Pretensioner Systems

Technological advancements in automotive safety systems are significantly influencing the Global Automotive Seat Belt Pretensioner Market Industry. Innovations such as electronic pretensioners and adaptive systems that adjust tension based on collision severity are becoming more prevalent. These advancements not only improve passenger safety but also enhance the overall performance of seat belt systems. As manufacturers integrate these technologies into their vehicles, the market for seat belt pretensioners is expected to expand. The introduction of smart seat belt systems that can communicate with other vehicle safety features further illustrates the potential for growth in this sector.

Growth of the Automotive Industry in Emerging Markets

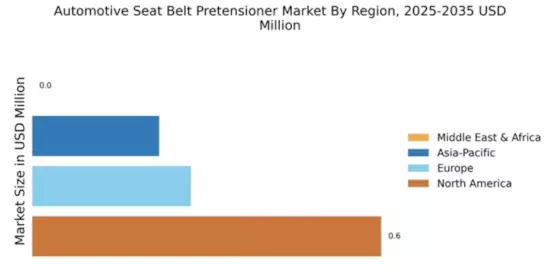

The expansion of the automotive industry in emerging markets is a key driver for the Global Automotive Seat Belt Pretensioner Market Industry. Countries such as India and Brazil are witnessing a surge in vehicle production and sales, leading to increased demand for safety features, including pretensioners. As these markets develop, the need for enhanced safety measures becomes more pronounced, prompting manufacturers to invest in advanced seat belt technologies. The projected growth of the automotive sector in these regions is expected to contribute to the market's overall expansion, with significant opportunities for pretensioner manufacturers.