Increasing Vehicle Production

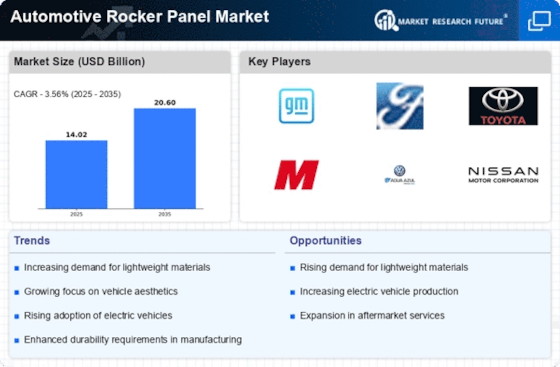

The Automotive Rocker Panel Market is experiencing growth due to the rising production of vehicles across various segments. As manufacturers ramp up production to meet consumer demand, the need for rocker panels, which provide structural integrity and aesthetic appeal, becomes more pronounced. In 2025, vehicle production is projected to reach approximately 90 million units, indicating a robust demand for automotive components. This surge in production not only drives the need for rocker panels but also encourages innovation in materials and manufacturing processes. Consequently, the Automotive Rocker Panel Market is likely to benefit from this upward trend, as manufacturers seek to enhance vehicle performance and safety through improved rocker panel designs.

Rising Demand for Electric Vehicles

The shift towards electric vehicles (EVs) is creating new opportunities within the Automotive Rocker Panel Market. As automakers increasingly focus on producing EVs, the design and materials used for rocker panels are evolving to accommodate the unique requirements of electric drivetrains. Lightweight materials are becoming more prevalent, as they contribute to improved energy efficiency and range. The growing popularity of EVs is projected to drive the demand for specialized rocker panels that enhance vehicle performance while adhering to sustainability goals. This trend indicates that the Automotive Rocker Panel Market will likely see a transformation as it adapts to the needs of the electric vehicle segment.

Consumer Preferences for Customization

Consumer preferences for vehicle customization are influencing the Automotive Rocker Panel Market. As buyers seek to personalize their vehicles, the demand for unique rocker panel designs and finishes is on the rise. This trend is particularly evident in the aftermarket segment, where consumers are willing to invest in aesthetic enhancements that reflect their individual style. Manufacturers are responding by offering a wider range of rocker panel options, including various colors, materials, and designs. This shift towards customization not only enhances the appeal of vehicles but also drives competition among manufacturers in the Automotive Rocker Panel Market, encouraging innovation and diversity in product offerings.

Regulatory Compliance and Safety Standards

The Automotive Rocker Panel Market is significantly influenced by stringent regulatory compliance and safety standards imposed by various authorities. These regulations often mandate the use of high-quality materials and designs that enhance vehicle safety and performance. For instance, rocker panels must meet specific crash safety standards, which can drive manufacturers to invest in advanced materials and technologies. As safety becomes a priority for consumers and manufacturers alike, the demand for compliant rocker panels is expected to rise. This trend suggests that the Automotive Rocker Panel Market will continue to evolve, adapting to new regulations while ensuring that vehicles remain safe and reliable.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are reshaping the Automotive Rocker Panel Market. Innovations such as automation, 3D printing, and advanced welding techniques are enhancing production efficiency and reducing costs. These technologies allow manufacturers to produce rocker panels with greater precision and at a faster rate, which is crucial in a competitive market. As the industry embraces these advancements, the quality and durability of rocker panels are likely to improve, meeting the evolving demands of consumers. The integration of technology in manufacturing processes is expected to propel the Automotive Rocker Panel Market forward, fostering a more efficient and innovative production landscape.