Market Trends

Key Emerging Trends in the Automotive Robotics Market

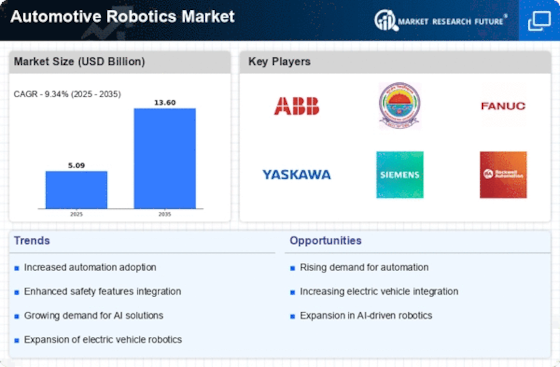

The automotive robotics industry is as of now going through huge changes, fundamentally because of the rising business sector interest in electric vehicles (EVs). Natural worries and the exceptional hardships related with electric vehicle production are persuading makers to dispense assets towards mechanical technology to handle the many-sided gathering requests of EV parts.

The mix of mechanical technology into the improvement of independent vehicles is a critical turn of events, moved by the requirement for cutting edge parts like cameras, sensors, and LiDAR frameworks. The headway of advanced mechanics in the car business is driven by the requirement for refined mechanization arrangements, which exhibits the area's devotion to creating cutting edge advancements that upgrade the wellbeing and productivity of independent vehicles.

Automotive robotics technology is seeing an expansion in the pervasiveness of cobots because of their ability to work couple with human administrators, in this way expanding versatility and adaptability. This change toward human-robot joint effort in car fabricating means to build efficiency, precision, and wellbeing. This progress means a significant shift in course towards achieving greatest effectiveness on the assembling office's premises.

To be sure, the automotive robotics industry is encountering a blossoming "lights-out" fabricating pattern, which incorporates completely mechanized creation offices that work without human mediation, in any event, during non-working hours. By coordinating man-made reasoning, high level advanced mechanics, and information examination, this innovation tries to further develop eco-friendliness, decrease functional costs, and increment creation limit. The reception of savvy plants in the car business is adding to the developing force of this efficiency pattern.

The automotive robotics market is going through a change towards Asia-Pacific countries like China, Japan, and South Korea because of elements including blossoming vehicle interest, industrialization, government drives, and quick assembling development. The quest for advanced mechanics answers for further develop producing capacities is continuous.

Automated frameworks keep on requiring master work force and involve significant starting venture costs. Innovative advances have worked with the arrangement of easy to understand, practical arrangements that empower little and medium-sized undertakings to embrace mechanical technology.

The automotive robotics industry is at present going through a time of massive change, as the execution of mechanical technology because of developing industry prerequisites, like the creation of electric and independent vehicles, cooperative robots, and lights-out assembling, advances supported extension and headway.

Leave a Comment