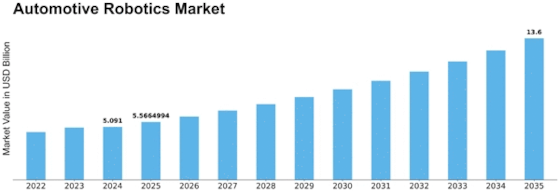

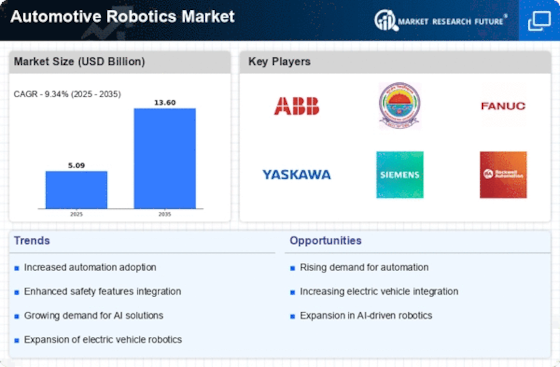

Automotive Robotics Size

Automotive Robotics Market Growth Projections and Opportunities

The automotive robotics market is being animated by the rising requirement for mechanization inside the area, which is persuaded by the longing to diminish human blunders and upgrade creation productivity. This request is a consequence of the auto business' quest for expanded effectiveness, diminished creation costs, and smoothed out tasks; consequently, mechanical technology combination is fundamental.

AI, and sensor abilities are among the innovative improvements that are pushing the market. These innovations add to smart production lines by expanding fabricating productivity. The reception of Industry 4.0 standards by the auto business is driving an expanded interest for computerization fit for flawlessly coordinating into cutting edge producing frameworks.

In light of the overall pattern towards supportability, the automotive robotics industry is giving arrangements that work with squander decrease and energy productivity in assembling processes. The accuracy and improvement abilities of advanced mechanics are in accordance with the auto business' naturally cognizant commitment, as they help in the preservation of assets.

Market elements are affected by administrative systems and security commitments, which inspire car producers to designate assets towards robotization arrangements that work on functional viability while sticking to thorough wellbeing conventions. Cooperative robots, otherwise called cobots, work related to human administrators to increase processing plant floor security and efficiency.

The car area's development and the speed increase of industrialization in locales, for example, Asia-Pacific are driving the extension of the automotive robotics market. The improvement of the market is powered by rising vehicle interest in arising economies and expanded interests in computerization innovation by key market members.

Regardless of significant introductory speculation, the automotive robotics market is persuaded by cost decreases, expanded efficiency, and improved item quality; profit from venture is a huge element.

The automotive robotics technology area is a unique framework shaped by the unpredictable transaction of various parts. The market is moved forward by the combination of innovative headways, natural awareness, administrative principles, geological consequences, and monetary contemplations. The rising development of the car business is supposed to additional highlight the meaning of mechanical technology in improving effectiveness, accuracy, and natural amicability. This will additionally lay out auto mechanical technology as a progressive power in contemporary assembling.

Leave a Comment