Cost-Effectiveness

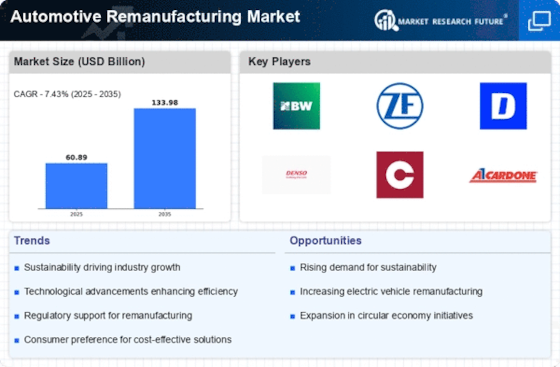

Cost-effectiveness remains a crucial driver in the Automotive Remanufacturing Market. Remanufactured parts typically offer substantial savings compared to their new counterparts, often ranging from 30% to 50% less in price. This affordability appeals to both consumers and businesses, particularly in an era where economic considerations are paramount. Moreover, the lower cost of remanufactured components does not compromise quality; many remanufactured parts meet or exceed original equipment manufacturer (OEM) specifications. As a result, fleet operators and individual consumers are increasingly opting for remanufactured parts as a viable alternative to new ones, thereby bolstering the industry's growth. The cost advantages associated with remanufacturing are likely to continue influencing purchasing decisions in the automotive sector.

Regulatory Support

Regulatory support is emerging as a significant driver for the Automotive Remanufacturing Market. Governments worldwide are recognizing the environmental benefits of remanufacturing and are implementing policies that encourage its adoption. This includes tax incentives, grants, and favorable regulations that promote the use of remanufactured parts in various applications. Such support not only enhances the competitiveness of remanufactured products but also fosters innovation within the industry. As regulations become more stringent regarding waste management and emissions, the remanufacturing sector is well-positioned to thrive. The alignment of regulatory frameworks with industry goals suggests a promising future for remanufacturing, as it becomes an integral part of sustainable automotive practices.

Technological Innovations

Technological advancements play a pivotal role in shaping the Automotive Remanufacturing Market. Innovations in manufacturing processes, such as advanced robotics and artificial intelligence, enhance the efficiency and precision of remanufacturing operations. For instance, the integration of AI-driven diagnostics allows for more accurate assessments of component viability, leading to higher quality remanufactured products. Additionally, the adoption of 3D printing technology facilitates the production of complex parts that may be difficult to remanufacture using traditional methods. As these technologies continue to evolve, they are likely to drive down costs and improve the overall quality of remanufactured components, thereby attracting a broader customer base and fostering growth within the industry.

Sustainability Initiatives

The Automotive Remanufacturing Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, manufacturers are compelled to adopt practices that minimize waste and reduce carbon footprints. Remanufacturing processes often utilize up to 85% less energy compared to producing new parts, which aligns with global efforts to combat climate change. Furthermore, remanufactured components contribute to a circular economy by extending the lifecycle of automotive parts. This shift not only appeals to environmentally conscious consumers but also encourages regulatory bodies to support remanufacturing through incentives. Consequently, the industry is witnessing a surge in demand for remanufactured products, as businesses and consumers alike prioritize sustainability in their purchasing decisions.

Consumer Awareness and Demand

Consumer awareness and demand are increasingly shaping the Automotive Remanufacturing Market. As consumers become more informed about the benefits of remanufactured parts, including cost savings and environmental advantages, their purchasing preferences are shifting. Surveys indicate that a growing number of consumers are willing to choose remanufactured components over new ones, driven by a desire to support sustainable practices. This heightened awareness is further fueled by marketing efforts that highlight the quality and reliability of remanufactured products. Consequently, manufacturers are responding to this demand by expanding their offerings and improving the visibility of remanufactured options. The increasing consumer inclination towards remanufactured parts is likely to propel the industry forward, creating new opportunities for growth.