Growth of the Automotive Aftermarket

The Automotive Push Rod Market is benefiting from the growth of the automotive aftermarket sector. As vehicle ownership rates rise, the demand for replacement parts, including push rods, is increasing. This trend is further fueled by the aging vehicle population, which necessitates regular maintenance and part replacements. Market data suggests that the aftermarket segment could account for nearly 30% of the total push rod market by 2026. This growth presents opportunities for manufacturers to diversify their product offerings and cater to a broader customer base. Consequently, the Automotive Push Rod Market is poised for expansion as it aligns with the needs of the aftermarket.

Increasing Demand for Fuel Efficiency

The Automotive Push Rod Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to innovate and enhance engine performance while reducing emissions. This trend is reflected in the growing adoption of lightweight materials and advanced engineering techniques, which contribute to improved fuel efficiency. According to recent data, vehicles equipped with optimized push rod systems can achieve up to 15% better fuel economy compared to traditional designs. Consequently, this heightened focus on fuel efficiency is driving investments in the Automotive Push Rod Market, as companies strive to meet regulatory standards and consumer expectations.

Rising Popularity of Performance Vehicles

The Automotive Push Rod Market is witnessing a rise in the popularity of performance vehicles, which is driving demand for high-performance push rod systems. Enthusiasts and consumers are increasingly seeking vehicles that offer superior power and handling, leading manufacturers to invest in advanced push rod technologies. This trend is particularly evident in the sports car segment, where performance metrics are paramount. As a result, the market for push rods designed for high-performance applications is expected to expand, with projections indicating a potential increase in market share by 10% over the next few years. This shift underscores the Automotive Push Rod Market's adaptability to consumer preferences.

Technological Advancements in Engine Design

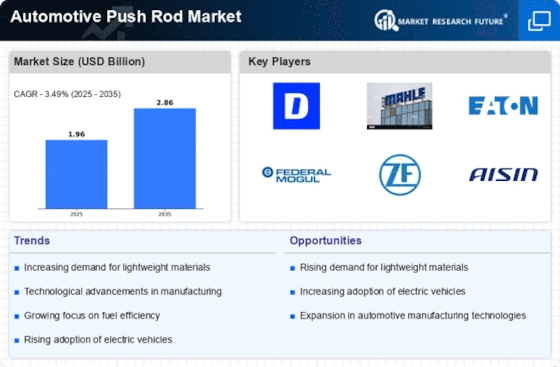

Technological advancements are significantly influencing the Automotive Push Rod Market. Innovations in engine design, such as the integration of variable valve timing and advanced combustion techniques, necessitate the use of sophisticated push rod systems. These systems are essential for optimizing engine performance and enhancing overall vehicle efficiency. The market is projected to grow as manufacturers increasingly adopt these technologies, with estimates suggesting a compound annual growth rate of approximately 5% over the next five years. This growth is indicative of the Automotive Push Rod Market's responsiveness to evolving engineering demands and the pursuit of higher performance standards.

Regulatory Compliance and Emission Standards

The Automotive Push Rod Market is significantly influenced by stringent regulatory compliance and emission standards. Governments worldwide are implementing more rigorous regulations aimed at reducing vehicular emissions, prompting manufacturers to innovate and enhance engine efficiency. Push rod systems play a crucial role in achieving these objectives, as they are integral to optimizing engine performance and reducing emissions. As a result, the market is likely to see increased investments in research and development to create compliant push rod technologies. This focus on regulatory adherence is expected to drive growth in the Automotive Push Rod Market, as companies strive to meet evolving standards and consumer expectations.