Increasing Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is a primary driver for the Automotive Power Module Packaging Market. As consumers increasingly prioritize sustainability and energy efficiency, automakers are responding by expanding their EV offerings. This shift necessitates advanced power module packaging solutions that can handle higher power densities and thermal management requirements. According to recent data, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. Consequently, the Automotive Power Module Packaging Market must adapt to these evolving needs, ensuring that packaging solutions are not only efficient but also capable of supporting the performance demands of next-generation electric drivetrains.

Regulatory Push for Emission Reductions

Regulatory frameworks aimed at reducing emissions are propelling the Automotive Power Module Packaging Market forward. Governments worldwide are implementing stringent emission standards, compelling automotive manufacturers to invest in cleaner technologies. This regulatory push is particularly evident in the transition towards hybrid and electric vehicles, which require efficient power module packaging to optimize energy use. As a result, the market for automotive power modules is expected to expand, with a projected increase in demand for packaging solutions that meet these regulatory requirements. The Automotive Power Module Packaging Market is thus positioned to benefit from these regulatory trends, as manufacturers seek to comply with evolving standards while enhancing vehicle performance.

Rising Focus on Vehicle Electrification

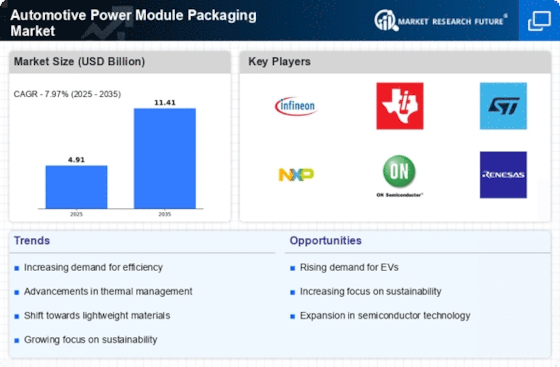

The rising focus on vehicle electrification is a pivotal driver for the Automotive Power Module Packaging Market. As automotive manufacturers increasingly prioritize electrification strategies, the demand for efficient power modules becomes paramount. This trend is reflected in the growing investment in research and development aimed at enhancing power module performance and reliability. Recent data suggests that the market for power modules in electrified vehicles is expected to grow significantly, with projections indicating a potential doubling of market size within the next five years. This surge in demand highlights the necessity for innovative packaging solutions that can support the evolving requirements of electrified powertrains, thereby positioning the Automotive Power Module Packaging Market for robust growth.

Growth of Autonomous Vehicle Technologies

The growth of autonomous vehicle technologies is emerging as a significant driver for the Automotive Power Module Packaging Market. As vehicles become increasingly automated, the demand for sophisticated power management systems rises. These systems require advanced packaging solutions that can accommodate the complex electronic architectures of autonomous vehicles. The integration of sensors, cameras, and computing units necessitates power modules that are not only compact but also capable of delivering high performance. Market analysts project that the autonomous vehicle segment will witness substantial growth, potentially reaching a market size of several billion dollars by the end of the decade. This trend underscores the critical role of the Automotive Power Module Packaging Market in supporting the future of mobility.

Technological Advancements in Semiconductor Materials

Technological advancements in semiconductor materials are significantly influencing the Automotive Power Module Packaging Market. Innovations such as silicon carbide (SiC) and gallium nitride (GaN) are enabling the development of more efficient power modules. These materials offer superior thermal conductivity and higher voltage capabilities, which are essential for modern automotive applications. The integration of these advanced materials is expected to enhance the performance and reliability of power modules, thereby driving market growth. Recent studies indicate that the adoption of SiC and GaN technologies could lead to a reduction in energy losses by up to 30%, further emphasizing the importance of these advancements in the Automotive Power Module Packaging Market.