Growth of Aftermarket Services

The Automotive Pneumatic Actuator Market is experiencing growth due to the expansion of aftermarket services and maintenance solutions. As vehicles age, the demand for replacement parts, including pneumatic actuators, increases significantly. This trend is driven by the need for maintaining vehicle performance and compliance with safety standards. Aftermarket services provide opportunities for manufacturers and suppliers to offer high-quality pneumatic actuators that meet or exceed original equipment specifications. Additionally, the rise of e-commerce platforms facilitates easier access to replacement parts for consumers, further stimulating the Automotive Pneumatic Actuator Market. Market data suggests that the aftermarket segment is expected to grow at a CAGR of around 5% over the next few years, indicating a robust opportunity for pneumatic actuator suppliers in the aftermarket space.

Rising Vehicle Production Rates

The Automotive Pneumatic Actuator Market is positively influenced by the rising production rates of vehicles worldwide. As economies recover and consumer confidence improves, automotive manufacturers ramp up production to meet the growing demand for personal and commercial vehicles. This increase in vehicle production directly correlates with the demand for pneumatic actuators, which are integral to various vehicle systems. For instance, pneumatic actuators are essential in controlling air intake and exhaust systems, thereby enhancing engine efficiency and performance. Recent statistics indicate that vehicle production is expected to reach over 100 million units annually by 2026, further propelling the Automotive Pneumatic Actuator Market. This trend suggests a sustained growth trajectory for pneumatic actuators as manufacturers seek to incorporate advanced technologies into their production processes.

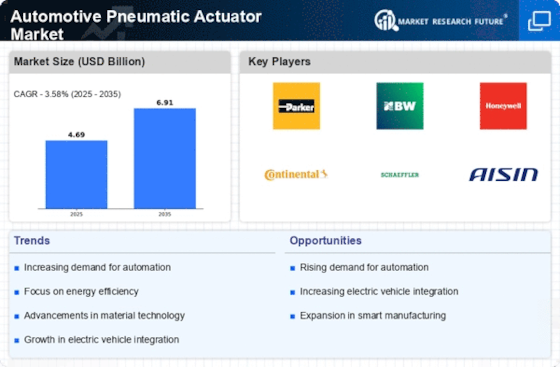

Increasing Demand for Automation

The Automotive Pneumatic Actuator Market experiences a notable surge in demand for automation across various vehicle systems. As manufacturers strive to enhance vehicle performance and efficiency, pneumatic actuators play a crucial role in automating functions such as throttle control, braking systems, and suspension adjustments. This trend is further supported by the automotive industry's shift towards advanced driver-assistance systems (ADAS) and autonomous vehicles, which require precise and reliable actuation mechanisms. According to recent data, the market for automotive actuators is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, indicating a robust expansion in the sector. Consequently, the increasing demand for automation is likely to drive the growth of the Automotive Pneumatic Actuator Market significantly.

Advancements in Material Technology

The Automotive Pneumatic Actuator Market benefits from advancements in material technology, which enhance the performance and durability of pneumatic actuators. Innovations in lightweight materials, such as composites and advanced polymers, allow for the production of more efficient and resilient actuators. These materials contribute to weight reduction in vehicles, thereby improving fuel efficiency and overall performance. Furthermore, the development of corrosion-resistant materials extends the lifespan of pneumatic actuators, making them more appealing to manufacturers. As the automotive industry increasingly prioritizes performance and sustainability, the integration of advanced materials into pneumatic actuator design is likely to drive growth in the Automotive Pneumatic Actuator Market. This trend indicates a potential for increased adoption of pneumatic actuators in various vehicle applications, aligning with the industry's focus on innovation.

Regulatory Compliance and Safety Standards

The Automotive Pneumatic Actuator Market is significantly influenced by stringent regulatory compliance and safety standards imposed by governments and industry bodies. As safety becomes a paramount concern in vehicle design, manufacturers are compelled to adopt advanced actuation technologies that meet these regulations. Pneumatic actuators are often favored for their reliability and precision in critical systems such as braking and steering. Compliance with safety standards not only enhances vehicle safety but also boosts consumer confidence, thereby driving demand for vehicles equipped with advanced pneumatic systems. Recent regulations have mandated the incorporation of fail-safe mechanisms in automotive systems, further propelling the need for high-quality pneumatic actuators. This regulatory landscape suggests a sustained growth opportunity for the Automotive Pneumatic Actuator Market as manufacturers adapt to evolving safety requirements.