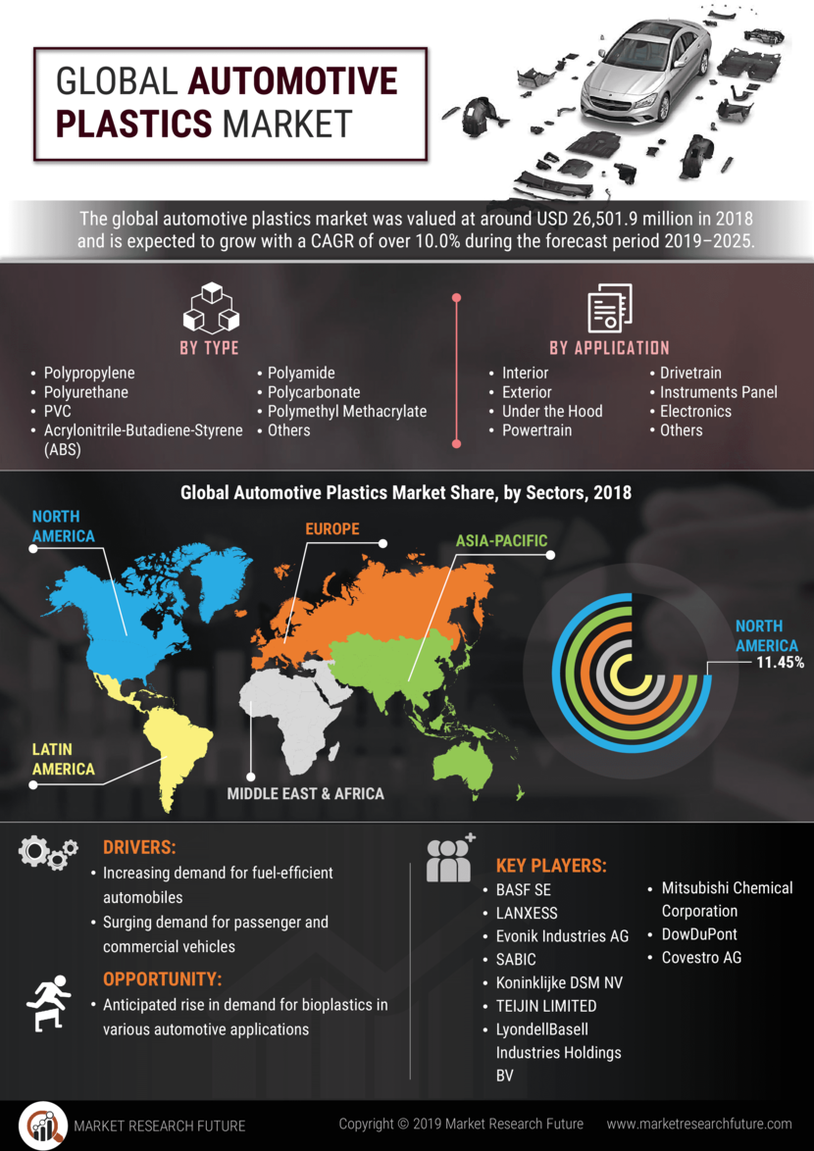

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Automotive Plastics Market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Automotive Plastics industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment. The major market players are investing a lot of money in R&D to expand their product lines, which will spur further market growth for Automotive Plastics Market. With significant market development like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their presence. To grow and thrive in a market climate that is becoming more competitive and growing, competitors in the Automotive Plastics industry must offer affordable products. Manufacturing locally to cut operating costs is one of the main business tactics manufacturers use in the Automotive Plastics industry to benefit customers and expand the market sector. The Low-Profile Additives market has recently given medicine some of the most important advantages. Major Automotive Plastics Market players, including Teijin Ltd (Japan), AkzoNobel N.V (Netherland), Evonik Industries (Germany), Johnson Controls (U.S.), and others, are attempting to increase market demand by funding R&D initiatives. Teijin is a company that engages in the materials, healthcare, and IT businesses. It develops and manufactures aramid products, carbon fibers, film sheets, resins, flame retardants, additives, composite molding materials, etc. In addition, the company offers pharmaceutical products, home healthcare devices, orthopedic implantable devices, and functional food ingredients, as well as inventory management systems. Also, AkzoNobel is a company that manufactures paints and coatings. It offers products such as decorative paints, automotive, specialty, marine, protective, yacht, industrial, and powder coatings. The company operates a number of brands, such as AkzoNobel, Alabastine, Alba, Apla, Cetol, Coral, Dulux, Flexa, Glitsa, Herbol, and Lesonal. LyondellBasell, a global innovation leader, is pleased to announce its participation in a ground-breaking value chain partnership aimed at repurposing end-of-life maritime waste into new polymers. This collaboration combines a well-known German OEM and a recycling company that specializes in mechanically recycling plastic waste. Traditionally, the automobile industry has only used recycled oceanic plastic as fibers for new vehicle components. Innovate UK's "resource efficiency for materials and manufacturing" (REforMM) program will award roughly £600,000 to a partnership led by sustainable technology pioneer Sonichem (previously Bio-Sep, Southampton, U.K.) in 2024. The financing will expedite the development of the unique Sonichem ultrasonic technology as well as the manufacturing of renewable, cost-effective alternatives to routinely used petrochemicals.