Market Share

Automotive Microcontrollers Market Share Analysis

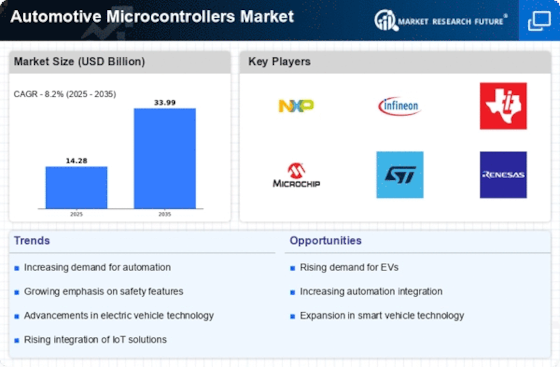

Automotive Microcontrollers Market members are putting an exceptional on mechanical development to keep an upper hand. Huge speculations are made in innovative work to make microcontrollers that display prevalent execution, energy proficiency, and mix abilities. This not just fulfils present requests in the auto business yet additionally positions them for impending progressions like independent driving and electric vehicles. To extend their market presence and integrate microcontrollers into the auto environment, it is fitting for organizations to lay out essential unions with automakers and framework integrators. This is especially pivotal given the ongoing interest for brought together correspondence among parts in vehicles. Valuing procedures fundamentally influence a business' portion of the overall industry. Associations might utilize a minimal expense way to deal with give serious microcontrollers that keep an exclusive requirement of value, though an exceptional evaluating system targets premium items with cutting edge highlights, in this way obtaining extra piece of the pie in portions where shoppers are more ready to pay. Associations deliberately expand their presence in key geographic regions to get to different business sectors and alleviate the likely adverse consequences of local monetary unpredictability and administrative adjustments. Developing business sectors offer critical possibilities for extension because of expanding auto producing and worked on innovative reception. Likewise, flexibility and personalization have arisen as basic parts chasing portion of the overall industry extension. Associations that offer adaptable microcontroller arrangements, which enable producers to change capabilities as per their particular necessities, get an upper hand. The previously mentioned versatility is extremely critical as auto makers look for microcontrollers that can definitively match the particulars of their vehicles, consequently furnishing them with an upper hand in the commercial center. The market for automotive microcontrollers is portrayed by unique techniques pointed toward procuring and growing piece of the pie. The scene is dominatingly recognized by mechanical progressions, vital organizations, evaluating systems, geographic development, and customization. Considering the continuous headways in electric vehicles, network, and independent driving, organizations that capably explore these systems will enjoy a serious benefit in the car area.

Leave a Comment