Market Analysis

In-depth Analysis of Automotive Microcontrollers Market Industry Landscape

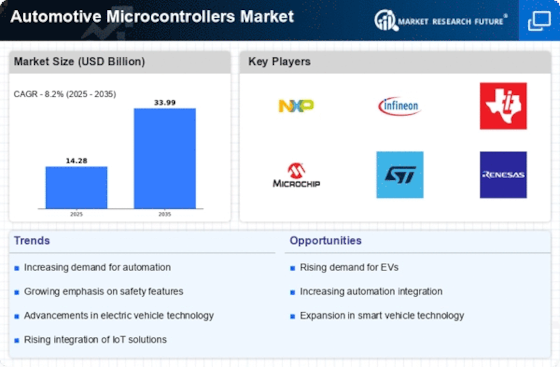

The automotive microcontrollers market is going through significant changes because of administrative tensions, innovative turns of events, and industry patterns. The raising requirement for these basic parts is pushed by the joining of electronic frameworks and the multifaceted nature of car applications, explicitly in electric and independent vehicles. This change requires progressed microcontrollers to play out various capabilities. The advancement desire of the car business is expanding interest for capable and strong microcontrollers. The rising joining of telematics, infotainment frameworks, and in-vehicle correspondence into vehicles has created an elevated interest for elite execution microcontrollers. Subsequently, regular models of these processors are being supplanted with further developed cycles that have improved functionalities. Microcontroller market elements are impacted by the worldwide auto industry, as makers change their procedures to suit the necessities of both laid out and developing business sectors. The foundation of refined highlights and financially savvy arrangements is dependent upon reasonableness. For wellbeing and outflow consistence, administrative structures and industry norms are convincing makers to incorporate electronic parts like microcontrollers, while the interest for cutting edge answers for independent driving advances stays prevailing. With an end goal to streamline applications, foster altered arrangements, and facilitate microcontroller incorporation into vehicle plans, car producers and microcontroller providers are laying out additional incessant organizations. This pattern is supposed to add to the development of the auto microcontrollers market. As vehicles become progressively interconnected, the automotive microcontrollers market is being affected by the extending online protection climate, which raises worries about framework weakness. Producers are presently committed to major areas of strength for coordinate highlights to defend vehicle capabilities and information, which has incited an accentuation on secure arrangements. The Automotive Microcontrollers Market displays many-sided and multi-layered elements, which are moulded by a juncture of innovative headways, industry-explicit patterns, administrative impacts, and cooperative drives. The development of independent and electric vehicles, the interest for upgraded proficiency and execution, adherence to guidelines, arrangement of key unions, and network protection concerns all in all add to the advancing space of automotive microcontrollers. The car business' continuous quest for development will definitely bring about a dynamic and versatile microcontroller market that stays receptive to the changing necessities of the auto environment.

Leave a Comment