Regulatory Push for Emission Control

The Automotive MEMS Sensor Market is significantly influenced by stringent regulations aimed at reducing vehicle emissions. Governments worldwide are implementing policies that require automakers to adopt advanced technologies to monitor and control emissions effectively. MEMS sensors are integral to these systems, providing real-time data on exhaust gases and enabling compliance with environmental standards. As a result, the demand for MEMS sensors in emission control applications is expected to rise. The automotive emissions control market is projected to witness substantial growth, further driving the Automotive MEMS Sensor Market as manufacturers seek to meet regulatory requirements.

Increasing Demand for Safety Features

The Automotive MEMS Sensor Market is experiencing a notable surge in demand for advanced safety features in vehicles. As consumers become more safety-conscious, manufacturers are integrating MEMS sensors to enhance vehicle safety systems. These sensors play a crucial role in applications such as airbag deployment, stability control, and collision avoidance systems. According to recent data, the automotive safety systems market is projected to grow significantly, with MEMS sensors being a key component. This trend indicates that the Automotive MEMS Sensor Market is likely to expand as automakers prioritize safety, potentially leading to increased adoption of MEMS technology in new vehicle models.

Growth of Electric and Hybrid Vehicles

The Automotive MEMS Sensor Market is benefiting from the increasing popularity of electric and hybrid vehicles. These vehicles require advanced sensor technologies to optimize performance, monitor battery health, and enhance energy efficiency. MEMS sensors are essential for applications such as battery management systems, powertrain control, and thermal management. The electric vehicle market is anticipated to grow at a rapid pace, with projections indicating that electric and hybrid vehicles could account for a significant share of total vehicle sales in the near future. This shift towards electrification is likely to bolster the Automotive MEMS Sensor Market as manufacturers adapt to new technological demands.

Consumer Preference for Connected Vehicles

The Automotive MEMS Sensor Market is also driven by the growing consumer preference for connected vehicles. As vehicles become increasingly integrated with digital technologies, the need for MEMS sensors to facilitate connectivity and data exchange is paramount. These sensors enable features such as real-time diagnostics, navigation assistance, and vehicle-to-everything communication. The connected car market is expected to expand rapidly, with estimates suggesting that a substantial percentage of new vehicles will be equipped with connectivity features in the coming years. This trend indicates a robust growth trajectory for the Automotive MEMS Sensor Market as automakers invest in sensor technologies to enhance the connected vehicle experience.

Technological Advancements in Sensor Capabilities

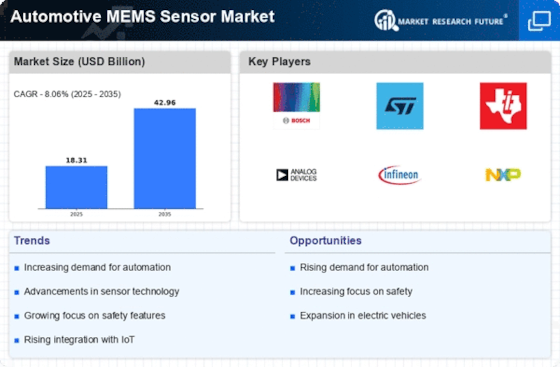

The Automotive MEMS Sensor Market is propelled by rapid technological advancements that enhance sensor capabilities. Innovations in microfabrication techniques and materials science have led to the development of more sensitive, reliable, and compact MEMS sensors. These advancements enable the integration of multiple sensing functionalities into a single device, which is particularly appealing for modern vehicles that require sophisticated monitoring systems. The market for MEMS sensors is expected to grow, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth reflects the increasing reliance on MEMS technology to meet the evolving demands of the automotive sector.