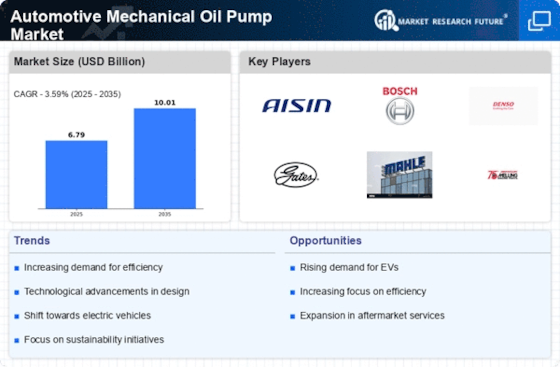

Increasing Vehicle Production

The Automotive Mechanical Oil Pump Market is experiencing a surge in demand due to the rising production of vehicles across various segments. As manufacturers ramp up production to meet consumer demand, the need for efficient oil pumps becomes paramount. In 2025, the automotive sector is projected to produce over 90 million vehicles, which directly correlates with the demand for mechanical oil pumps. This increase in vehicle production not only drives the market but also encourages innovation in pump design and efficiency. Consequently, manufacturers are focusing on developing advanced oil pumps that can enhance engine performance and longevity, thereby solidifying their position in the Automotive Mechanical Oil Pump Market.

Rising Engine Performance Standards

The Automotive Mechanical Oil Pump Market is significantly influenced by the rising standards for engine performance. As consumers demand more powerful and efficient engines, manufacturers are compelled to enhance their oil pump technologies. In recent years, there has been a notable shift towards high-performance engines that require precise oil delivery for optimal functioning. This trend is expected to continue, with the market for high-performance vehicles projected to grow by approximately 5% annually. Consequently, the demand for advanced mechanical oil pumps that can meet these stringent performance criteria is likely to increase, thereby propelling the Automotive Mechanical Oil Pump Market forward.

Growing Aftermarket Services and Maintenance

The Automotive Mechanical Oil Pump Market is also driven by the growing emphasis on aftermarket services and maintenance. As vehicles age, the need for replacement parts, including oil pumps, becomes increasingly critical. The aftermarket segment is projected to grow at a rate of approximately 4% annually, driven by the rising number of vehicles on the road. This trend highlights the importance of reliable oil pumps in maintaining engine health and performance. Consequently, manufacturers are focusing on providing high-quality replacement pumps that meet or exceed original equipment specifications. This focus on aftermarket services is likely to bolster the Automotive Mechanical Oil Pump Market, ensuring sustained demand for mechanical oil pumps.

Regulatory Compliance and Emission Standards

The Automotive Mechanical Oil Pump Market is also shaped by stringent regulatory compliance and emission standards imposed by governments worldwide. As environmental concerns escalate, regulations regarding vehicle emissions have become more rigorous. This has led manufacturers to innovate and develop oil pumps that not only comply with these standards but also enhance fuel efficiency. For instance, the implementation of Euro 7 standards is anticipated to drive the demand for more efficient oil pumps that can support cleaner engine technologies. As a result, the Automotive Mechanical Oil Pump Market is likely to witness a shift towards pumps that contribute to lower emissions and improved fuel economy.

Technological Innovations in Oil Pump Design

The Automotive Mechanical Oil Pump Market is benefiting from ongoing technological innovations in oil pump design. Advances in materials and engineering techniques have led to the development of more durable and efficient oil pumps. For example, the introduction of lightweight materials and advanced manufacturing processes has enabled the production of pumps that can withstand higher pressures and temperatures. This trend is expected to continue, with the market for innovative oil pump designs projected to grow significantly. As manufacturers strive to enhance the performance and reliability of their products, the Automotive Mechanical Oil Pump Market is likely to see a proliferation of cutting-edge technologies that redefine pump capabilities.