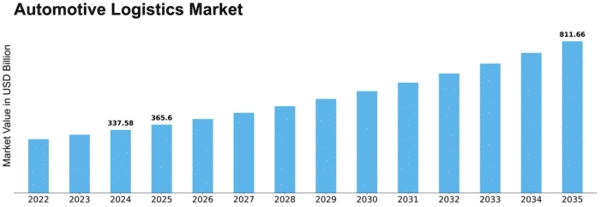

Automotive Logistics Size

Automotive Logistics Market Growth Projections and Opportunities

One of the drivers of this market is the worldwide automotive industry's persistent development and advancement. As the interest for vehicles rises around the world, producers and providers are constrained to smooth out their logistics activities to meet this developing need. The automotive logistics market is complicatedly connected to the creation and dissemination of vehicles, making it exceptionally receptive to uncertainties in the automotive industry. Another basic component affecting the automotive logistics market is the topographical distribution of assembling center points and purchaser markets. The business' calculated scene is profoundly influenced by the areas of significant vehicle makers and their essential choices with respect to creation offices. Closeness to providers, markets, and transportation courses assumes a significant part in deciding the productivity and cost-viability of automotive logistics tasks. The progressions in innovation additionally fundamentally add to making the automotive logistics market. The reconciliation of state-of-the-art advancements, for example, GPS following, continuous observing, and computerization, has reformed production network the executives in the automotive area. Additionally, the rising utilization of information examination and computerized reasoning guides in anticipating request, streamlining stock levels, and settling on informed vital choices in the automotive logistics space. The business is dependent upon a bunch of guidelines overseeing transportation, emanations, wellbeing principles, and exchange rehearses. Consistency with these guidelines is not just fundamental for legitimate reasons yet additionally influences the effectiveness and cost construction of logistics activities. Changes in administrative structures can prompt changes in logistics methodologies, influencing the general elements of the automotive logistics market. In the field of vehicle logistics, the ecological maintainability pattern is becoming distinctly more noticeable. Considerations related to maintainability are increasingly shaping the processes and responsibilities of automobile logistics providers. Market competition is a reliable and compelling indicator for the automotive logistics sector. In this very competitive environment, the ability to adapt to shifting market conditions, advance logistical cycles, and propose financially astute solutions is critical for success. These external financial factors outline challenges and provide opportunities for automotive logistics collaborators, requiring them to be agile and responsive to shifting market dynamics.

Leave a Comment