Market Analysis

In-depth Analysis of Automotive Fuel Rail Market Industry Landscape

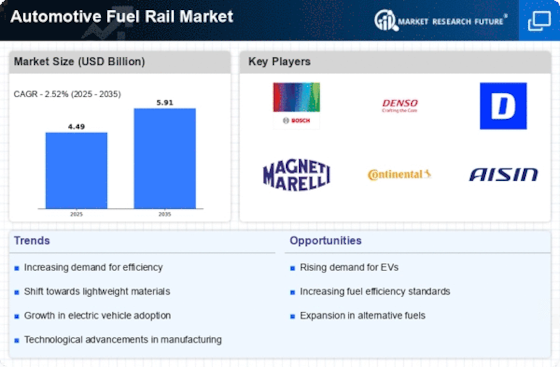

The Automotive Fuel Rail Market is being affected by a number of factors that altogether decide the manner in which the market’s dynamics and growth play out. The one main factor that dictates the health and effectiveness of the global automotive industry is its performance as a whole. Fuel rails demand also changes as the car industry grows or contracts in terms of fuel rails. The economy, customer attitudes, and rules for the game decide what road the business will take. What is more, among the factors that create a demand for fuel rails are the increased pollution restrictions and the increasing priority given to fuel economy by governments.

The technologic progression also remains the major factor governing the Automotive Fuel Rail Market. The drive to innovate by car maker to produce vehicles that are able to meet changing customer need leads to the adoption of modern technologies in the route system. The invention of lightweight materials, smart sensors and electronic controls boost the effective working of the fuel rails. This impacts the market growth in this respect. Moreover, the rising tendency of the electric and hybrid vehicles towards the market's progressive development are also connected to the need for alternative fuel rail supplies for these special propulsion systems.

Along the with the fuel prices and availability, the Automotive Fuel Rail Market is also greatly influenced. Price volatility in oil disrupts consumer choice patterns, making cars that have fuel efficiency more popular when fuel prices are higher. As a result, the OEMs invest into advancements in the fuel systems which include the fuel rails among others. Also, another layer is added to the market dynamic, making the selection process more complex as various types of alternative fuels including biofuels and hydrogen are becoming available for fuel rail manufactures to cater to different fuel types and compositions.

Stringent government regulated emissions and vehicle safety standards have a comprehensive impact on Automotive Fuel Rail Market. The tight fuel efficiency regulations is compelling automakers to develop more superior fuel injection systems and cleaner fuels for which the specific fuel rails would be designed based on the regulations. Also, safety standards nominate the design and materials of fuel rail fabrication which not only affect the product development but market trends as well.

Factors which compose the competitive landscape of the Fuel Rail Market in Automotive are the market concentration, mergers and acquisitions and strategic alliances. Through acquisition, large automotive component producers frequently absorb smaller players aiming at increasing their global presence, as well as offering a wider range of products and services. The rising trend of customer-centricity is fast leading to market consolidation, creating a competitive atmosphere where companies vie for differentiation in technology, product quality, and cost-effectiveness.

Leave a Comment