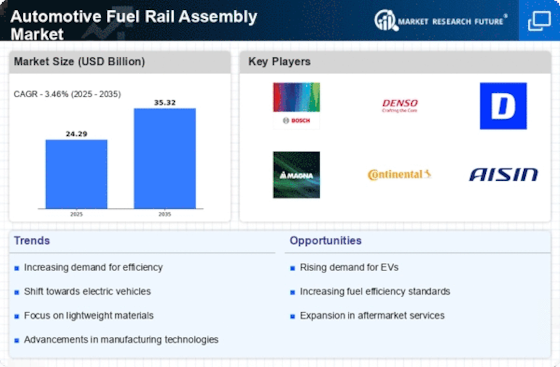

Rising Demand for Fuel Efficiency

The Automotive Fuel Rail Assembly Market is significantly influenced by the rising demand for fuel efficiency among consumers and manufacturers alike. As fuel prices fluctuate, there is an increasing emphasis on optimizing fuel consumption in vehicles. The integration of advanced fuel rail assemblies plays a crucial role in achieving this goal, as they facilitate more precise fuel delivery to the engine. Market data indicates that vehicles equipped with high-performance fuel rail systems can achieve up to 20% better fuel economy compared to traditional systems. This trend is likely to propel the Automotive Fuel Rail Assembly Market forward, as manufacturers strive to meet consumer expectations for fuel-efficient vehicles while adhering to stringent regulatory standards.

Growth of the Electric Vehicle Segment

The Automotive Fuel Rail Assembly Market is witnessing a transformation due to the growth of the electric vehicle segment. Although electric vehicles (EVs) do not utilize traditional fuel rail assemblies, the increasing prevalence of hybrid vehicles necessitates the integration of advanced fuel rail systems. As hybrid technology continues to evolve, the demand for efficient fuel rail assemblies that can work in conjunction with electric powertrains is expected to rise. Market analysts suggest that the hybrid vehicle segment could account for a substantial share of the Automotive Fuel Rail Assembly Market in the coming years, as manufacturers seek to balance performance with environmental considerations.

Regulatory Compliance and Emission Standards

The Automotive Fuel Rail Assembly Market is also shaped by stringent regulatory compliance and emission standards imposed by governments worldwide. As environmental concerns escalate, regulatory bodies are enforcing stricter emissions regulations, compelling manufacturers to adopt advanced fuel rail technologies that minimize harmful emissions. The market is projected to grow as companies invest in innovative fuel rail assemblies that comply with these regulations. For instance, the implementation of fuel rail systems that reduce nitrogen oxide emissions is becoming a priority for many automotive manufacturers. This regulatory landscape is likely to drive the Automotive Fuel Rail Assembly Market, as compliance becomes essential for market competitiveness and sustainability.

Technological Advancements in Fuel Rail Systems

The Automotive Fuel Rail Assembly Market is experiencing a surge in technological advancements that enhance performance and efficiency. Innovations such as direct fuel injection systems are becoming increasingly prevalent, allowing for better fuel atomization and combustion. This shift is expected to drive the market, as manufacturers seek to improve engine performance and reduce emissions. According to recent data, the adoption of advanced fuel rail assemblies is projected to increase by approximately 15% over the next five years. These advancements not only improve fuel efficiency but also contribute to the overall reduction of greenhouse gas emissions, aligning with global environmental standards. As a result, the Automotive Fuel Rail Assembly Market is likely to witness significant growth driven by these technological innovations.

Consumer Preference for High-Performance Vehicles

The Automotive Fuel Rail Assembly Market is significantly impacted by consumer preferences shifting towards high-performance vehicles. As consumers increasingly seek vehicles that offer superior acceleration and power, manufacturers are compelled to enhance engine performance through advanced fuel rail assemblies. These systems are designed to deliver fuel more efficiently, thereby improving engine responsiveness and overall driving experience. Market data suggests that the demand for high-performance vehicles is expected to grow by approximately 10% annually, driving the need for innovative fuel rail technologies. Consequently, the Automotive Fuel Rail Assembly Market is likely to expand as manufacturers invest in developing fuel rail systems that cater to the performance-oriented consumer.