Growing Electric Vehicle Market

The Automotive Foam Market is poised for growth due to the rapid expansion of the electric vehicle (EV) market. As EV manufacturers seek to optimize vehicle weight and enhance battery efficiency, the demand for specialized foams that provide thermal insulation and sound dampening is increasing. These foams are essential in managing the unique challenges posed by electric drivetrains. The Automotive Foam Market is projected to reach over 30 million units by 2030, creating substantial opportunities for foam manufacturers to cater to this emerging segment. This shift not only supports the automotive industry's transition towards electrification but also highlights the critical role of innovative foam solutions in enhancing EV performance.

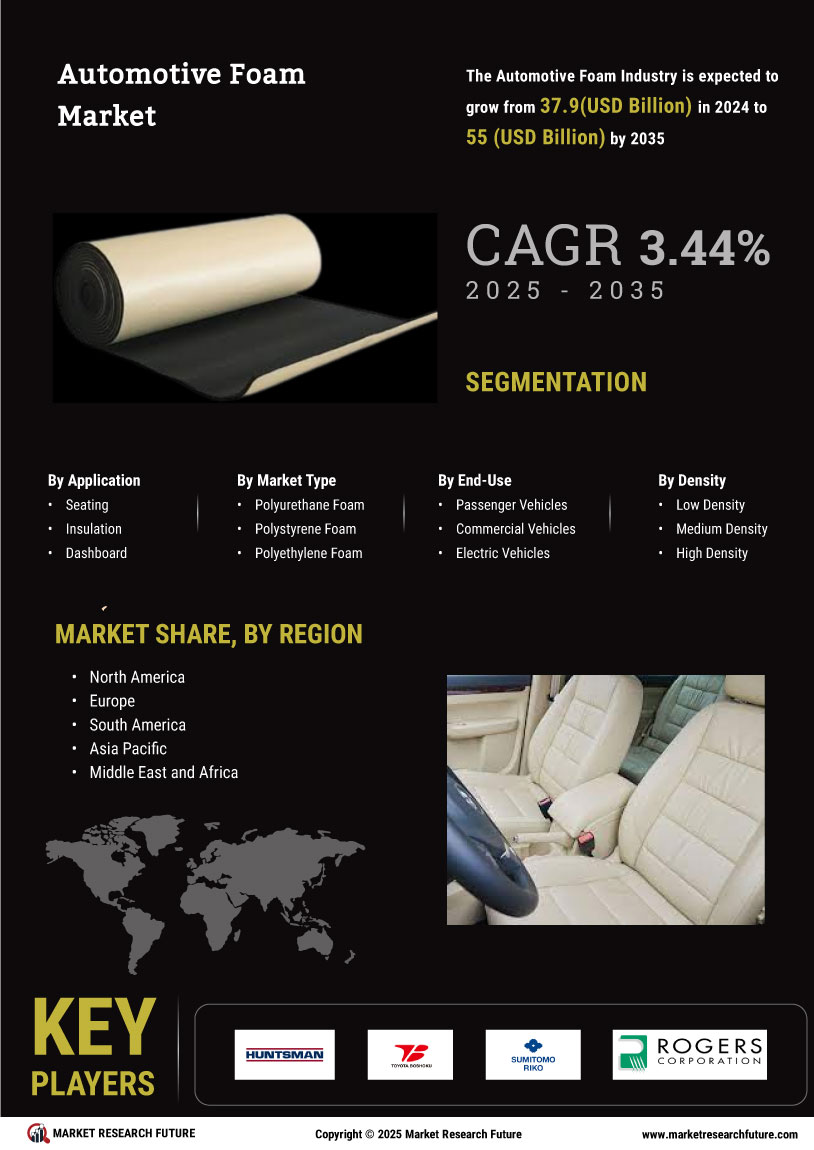

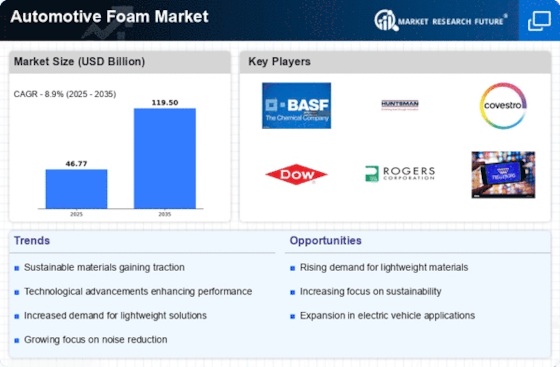

Rising Demand for Lightweight Materials

The Automotive Foam Market experiences a notable surge in demand for lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. As manufacturers strive to meet stringent environmental regulations, the adoption of lightweight foams becomes increasingly prevalent. For instance, polyurethane and polyethylene foams are favored for their excellent strength-to-weight ratios. The market for automotive foams is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% over the next few years, indicating a robust shift towards materials that contribute to overall vehicle performance and sustainability. This trend not only aligns with consumer preferences for eco-friendly vehicles but also supports manufacturers in achieving compliance with global emissions standards.

Technological Innovations in Foam Production

Technological advancements play a pivotal role in shaping the Automotive Foam Market. Innovations in foam production techniques, such as the development of bio-based foams and improved manufacturing processes, are gaining traction. These advancements not only enhance the performance characteristics of automotive foams but also contribute to sustainability efforts. For instance, the introduction of water-blown foams reduces the reliance on harmful chemicals, aligning with the industry's shift towards greener alternatives. Furthermore, the integration of smart materials that respond to environmental changes is expected to revolutionize the market. As a result, the automotive foam segment is anticipated to witness a growth rate of around 6% annually, driven by these technological breakthroughs.

Increased Focus on Comfort and Safety Features

The Automotive Foam Market is significantly influenced by the growing emphasis on comfort and safety features in vehicles. As consumers increasingly prioritize a comfortable driving experience, manufacturers are integrating advanced foam materials into seating, headliners, and interior components. The use of viscoelastic foams, for example, enhances comfort while providing necessary support. Additionally, safety regulations are becoming more stringent, prompting manufacturers to utilize foams that absorb impact energy, thereby improving passenger safety. The market for automotive seating foams alone is expected to reach USD 10 billion by 2026, reflecting the industry's commitment to enhancing both comfort and safety through innovative foam solutions.

Regulatory Compliance and Environmental Standards

The Automotive Foam Market is significantly impacted by evolving regulatory compliance and environmental standards. Governments worldwide are implementing stricter regulations aimed at reducing vehicle emissions and promoting sustainable materials. This regulatory landscape compels automotive manufacturers to adopt eco-friendly foam solutions that meet these standards. For instance, the use of recyclable and biodegradable foams is becoming increasingly important in vehicle design. As a result, the market for automotive foams is expected to grow in response to these regulatory pressures, with an estimated increase of 4.5% in demand for compliant materials over the next five years. This trend underscores the importance of aligning product offerings with environmental expectations to remain competitive in the automotive sector.