- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

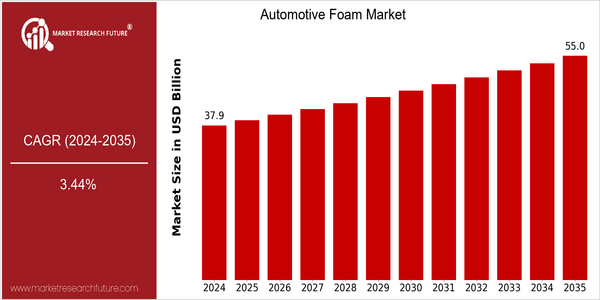

| Year | Value |

|---|---|

| 2024 | USD 37.9 Billion |

| 2035 | USD 55.0 Billion |

| CAGR (2025-2035) | 3.44 % |

Note – Market size depicts the revenue generated over the financial year

The market for automobile foam is growing steadily. Its present value is $ 37.9 billion and it is expected to grow to $ 55.0 billion by 2035. The annual growth rate of this market is 3.44 per cent from 2025 to 2035. The growth of this market can be attributed to many factors, such as the growing demand for lightweight materials in the manufacture of automobiles, which increases fuel efficiency and reduces exhaust emissions. Also, the development of new foam materials such as high-density polyurethane and polyethylene foams are driving innovation and increasing the use of foam in various applications such as seats, insulating materials and soundproofing materials. The major players in the automobile foam market, such as BASF, The Dow Chemical Company and Huntsman Corp., are constantly investing in R & D to develop more efficient and sustainable foam solutions. Strategic initiatives such as collaborations and acquisitions to improve the product portfolio and market reach are also expected to drive this market.

Regional Market Size

Regional Deep Dive

The booming global market for automobile foam is driven by the increasing demand for lightweight materials, enhanced comfort and noise reduction in automobiles. In North America, the market is characterized by a strong automobile industry and a growing trend toward electric vehicles, which require advanced foam solutions for battery insulation and lightweighting. In Europe, the focus is on sustainable materials and new foam technology. The Asia-Pacific region is growing fast due to the high production of automobiles and the strong demand from consumers. The Middle East and Africa are gradually adopting automobile foam solutions, driven by the growing importance of the automobile industry and the growing number of cars on the road. Latin America is still a developing market, but there is great potential in the growing automobile industry and in the investments in production capacity.

Europe

- Europe is leading the charge in sustainable automotive foam solutions, with companies like BASF and Covestro developing bio-based foams that reduce environmental impact, aligning with the EU's Green Deal initiatives.

- The European automotive industry is also focusing on innovations in sound-absorbing foams, driven by consumer demand for quieter vehicles, with major players like Volkswagen and BMW investing in R&D for advanced acoustic materials.

Asia Pacific

- In Asia-Pacific, where automobile production is on the increase, and especially in China and India, advanced foams are being increasingly used to meet the demands for comfort and performance.

- Government initiatives in China, such as the 'Made in China 2025' plan, are promoting the use of high-performance materials in the automotive sector, leading to increased investments in foam manufacturing capabilities.

Latin America

- Latin America is experiencing growth in its automotive sector, with countries like Brazil and Mexico becoming key manufacturing hubs, leading to increased demand for automotive foams as local production ramps up.

- Ford and Volkswagen are investing in the region and bringing their foam technology to the next level. Foams, as light, sustainable materials, are now an essential requirement of international car standards.

North America

- The North American foam industry has been greatly influenced by the development of the electric vehicle. Companies such as Tesla and GM have invested heavily in the development of lightweight foam materials for the purpose of battery insulating and vehicle reducing.

- The new regulations relating to the safety and exhaustion of motor cars are pushing the manufacturers towards the use of these new materials. In the United States, the National Highway Traffic Safety Administration (NHTSA) is playing an important part in these regulations.

Middle East And Africa

- The Middle East is seeing a gradual increase in automotive foam adoption, driven by infrastructural developments and a growing middle class, with companies like Al-Futtaim Automotive investing in local manufacturing capabilities.

- Regulatory frameworks in the region are evolving, with governments focusing on improving vehicle safety standards, which is expected to drive demand for advanced foam solutions in automotive applications.

Did You Know?

“Did you know that automotive foams can reduce vehicle weight by up to 30%, significantly improving fuel efficiency and reducing emissions?” — Automotive Foam Market Research Report, 2023

Segmental Market Size

The world market for foams in the automobile industry is growing steadily. The main reasons are the increasing demand for lightweight materials which improve fuel economy and reduce emissions. Also, the consumer's desire for comfort and quiet in the car. In order to meet these requirements, companies such as BASF and Huntsman are developing new foams. The use of foams in cars is currently at a very high level. Foams are widely used in all kinds of vehicles in North America and Europe. Foams are used in the seats, soundproofing and the trim of the car. Foams are used in Ford, BMW and other automobile companies to enhance the comfort of the driver and passengers. The trend towards electric cars and the use of eco-friendly materials is likely to increase the demand for foams in the future. Polyurethane and viscoelastic foams are shaping the evolution of the foam industry. They provide high performance and long-lasting performance in the automobile industry.

Future Outlook

The Automotive Foam Market is estimated to grow at a CAGR of 3.44% from 2024 to 2035, from $37.9 billion to $55 billion. This growth is due to the rising demand for lightweight materials, which reduce fuel consumption and CO2 emissions, in line with the international goal of sustainable development. The penetration of automotive foams into vehicle production will increase, especially in the areas of seats, soundproofing and soundproofing. The development of bio-based and recyclable foam materials is expected to drive the market. Also, the integration of smart materials that react to the environment will increase the functionality of the interior of the car. Also, the growing use of electric vehicles (EVs) is expected to open up new opportunities for the use of foam in cars, as EVs often require special insulating and lightweight materials for optimum performance. As the demand for more comfortable and sustainable driving experiences grows, the market for automobile foams will expand, supported by continued investment in research and development and government policies that encourage the use of sustainable materials in the automotive industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 42.43 Billion |

| Growth Rate | 8.90% (2024-2032) |

Automotive Foam Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.