Enhanced Vehicle Connectivity

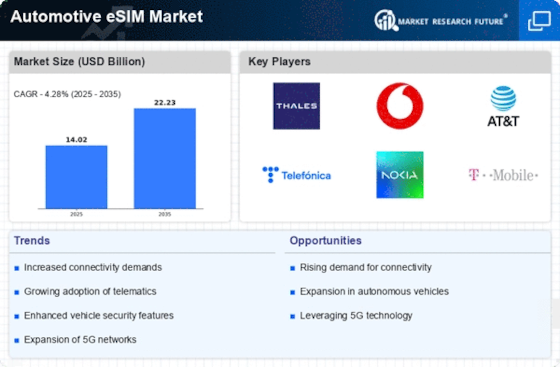

The Automotive eSIM Market is experiencing a surge in demand for enhanced vehicle connectivity. As vehicles become increasingly integrated with advanced technologies, the need for seamless connectivity solutions has become paramount. eSIMs facilitate over-the-air updates, allowing manufacturers to improve vehicle performance and introduce new features without requiring physical access to the vehicle. This capability is particularly appealing in the context of connected car services, which are projected to reach a market size of approximately 200 billion dollars by 2025. The ability to provide real-time data and services enhances the overall driving experience, making eSIMs a critical component in modern automotive design.

Increased Focus on Data Security

The Automotive eSIM Market is witnessing an increased focus on data security as vehicles become more connected. With the rise of cyber threats, manufacturers are prioritizing secure communication channels to protect sensitive data transmitted between vehicles and external networks. eSIMs offer enhanced security features, such as remote provisioning and secure authentication, which are essential for safeguarding vehicle data. As the automotive industry invests in cybersecurity measures, the demand for secure eSIM solutions is expected to rise. This trend indicates a potential growth trajectory for the eSIM market, as manufacturers seek to ensure the integrity and confidentiality of vehicle communications.

Growing Adoption of Electric Vehicles

The Automotive eSIM Market is closely linked to the growing adoption of electric vehicles (EVs). As the automotive sector shifts towards electrification, the demand for advanced connectivity solutions has intensified. eSIMs play a vital role in managing the complex data requirements of EVs, including battery management systems and charging infrastructure. With the number of EVs on the road expected to exceed 30 million by 2025, the integration of eSIM technology is likely to become a standard feature in new models. This trend not only supports the operational efficiency of EVs but also enhances the user experience through connected services, thereby driving the eSIM market forward.

Regulatory Compliance and Safety Standards

The Automotive eSIM Market is significantly influenced by regulatory compliance and safety standards. Governments worldwide are increasingly mandating the integration of advanced safety features in vehicles, which often require robust connectivity solutions. eSIMs enable manufacturers to comply with these regulations by providing real-time data transmission for safety systems, such as emergency call services and vehicle tracking. As regulations evolve, the need for eSIM technology is expected to grow, with estimates suggesting that the market could expand by over 15% annually in response to these compliance requirements. This regulatory push is likely to solidify the role of eSIMs in the automotive sector.

Integration of Advanced Infotainment Systems

The Automotive eSIM Market is being propelled by the integration of advanced infotainment systems in vehicles. As consumer expectations for in-car entertainment and connectivity rise, manufacturers are increasingly incorporating eSIM technology to support these features. eSIMs enable seamless access to streaming services, navigation, and real-time traffic updates, enhancing the overall driving experience. The infotainment system market is projected to grow significantly, with estimates suggesting it could reach 50 billion dollars by 2025. This growth is likely to drive the demand for eSIMs, as they provide the necessary infrastructure for delivering high-quality, connected infotainment experiences in modern vehicles.