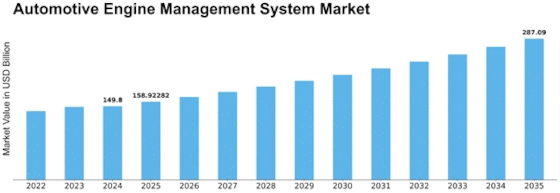

Automotive Engine Management System Size

Automotive Engine Management System Market Growth Projections and Opportunities

In recent years, the security challenges faced by public transportation systems have been on a steady rise, prompting a need for effective crowd management. Controlling the influx of people in public transportation systems has become a critical focus for security authorities worldwide. The adoption of Passenger Information Systems (PIS) has emerged as a key strategy to mitigate security threats in crowded areas, with the primary objective of estimating and managing the number of people in transit. This data becomes crucial for authorities to formulate contingency plans and take prompt action when passenger limits are exceeded.

Passenger Information Systems find wide-ranging applications, particularly in video surveillance and video analytics for various modes of transportation, including railways, airports, and public transport buses. The contemporary surge in passenger numbers, attributed to factors such as increased job mobility, business travel, and leisure activities, has accentuated the need for robust security measures in these transit systems. Government regulations stipulate maximum vehicle capacities, but ensuring compliance requires a reliable and efficient passenger information system to monitor and manage passenger loads, making it a vital tool for law enforcement.

One of the primary functions of Passenger Information Systems is to facilitate video surveillance and analytics. These systems play a pivotal role in enhancing the overall security infrastructure of railways, airports, and public buses. By leveraging advanced technologies, such as facial recognition and behavioral analysis, PIS can efficiently monitor and manage crowds, identifying potential security threats and unusual activities. This proactive approach is essential for preventing incidents before they escalate, contributing significantly to the overall safety of public transportation systems.

As governments and security authorities strive to uphold regulations related to vehicle capacities, the Passenger Information System becomes indispensable for ensuring adherence and avoiding legal violations. By providing real-time data on passenger numbers, these systems empower authorities to take swift action in case of overcrowding, thereby contributing to the overall safety and security of commuters. The integration of PIS with enforcement mechanisms not only aids in law enforcement but also serves as a deterrent, dissuading potential violators and enhancing overall compliance with transportation regulations.

Moreover, Passenger Information Systems prove to be invaluable in emergency situations, such as hijackings, bomb threats, and assaults within public transport. In these critical moments, the ability to quickly and accurately determine the location of the vehicle is paramount for law enforcement and emergency response teams. The real-time data provided by PIS allows authorities to swiftly deploy resources to the precise location, minimizing response times and potentially preventing or mitigating the impact of a security incident.

The continuous growth of security concerns in public transportation is a driving force behind the expansion of the Passenger Information System Market. The evolving nature of security threats requires innovative and technologically advanced solutions, and PIS stands out as a crucial component in the arsenal of tools available to security authorities. As the demand for safer public transportation systems continues to escalate, the market for Passenger Information Systems is poised for sustained growth and development.

In conclusion, the escalating security concerns in public transportation systems necessitate a strategic and technology-driven approach. Passenger Information Systems emerge as a linchpin in addressing these concerns by providing real-time data on passenger numbers, enabling efficient crowd management, and enhancing overall security through video surveillance and analytics. As the demand for safer and more secure public transportation options grows, the Passenger Information System Market is set to play a pivotal role in shaping the future of transit security.

Leave a Comment