Rising Consumer Awareness

Consumer awareness regarding environmental issues is on the rise, influencing the Automotive Emission Test Equipment Market. As individuals become more informed about the impact of vehicle emissions on health and the environment, there is a growing demand for transparency in automotive emissions. This shift in consumer behavior is prompting manufacturers to prioritize compliance with emission standards, thereby increasing the need for reliable testing equipment. Furthermore, the trend towards sustainability is encouraging automotive companies to adopt cleaner technologies, which in turn drives the demand for advanced emission testing solutions. The market is likely to benefit from this heightened awareness, as consumers increasingly favor brands that demonstrate a commitment to reducing their environmental footprint.

Growth of the Automotive Industry

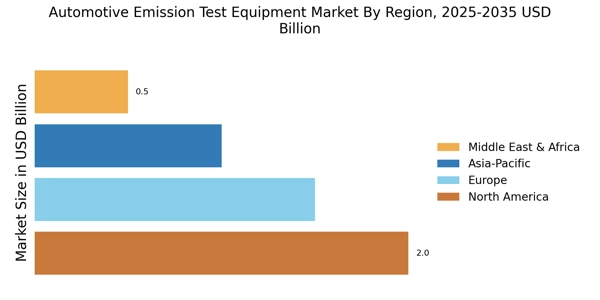

The Automotive Emission Test Equipment Market is closely linked to the overall growth of the automotive sector. As vehicle production increases, so does the need for effective emission testing solutions. The rise in vehicle ownership, particularly in emerging markets, is contributing to this growth. According to industry reports, the automotive sector is projected to grow at a steady pace, with millions of new vehicles expected to be produced annually. This expansion necessitates the implementation of stringent emission testing protocols, thereby driving demand for advanced testing equipment. Consequently, the market for automotive emission test equipment is poised for substantial growth, reflecting the broader trends within the automotive industry.

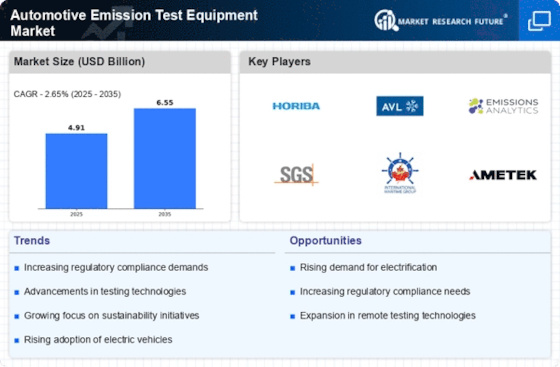

Increasing Environmental Regulations

The Automotive Emission Test Equipment Market is experiencing a surge in demand due to the tightening of environmental regulations across various regions. Governments are implementing stricter emission standards to combat air pollution and climate change. For instance, regulations such as the Euro 6 standards in Europe and the Tier 3 standards in the United States have necessitated the use of advanced emission testing equipment. This regulatory landscape compels automotive manufacturers to invest in sophisticated testing technologies to ensure compliance, thereby driving the market for emission test equipment. As a result, the industry is likely to witness a robust growth trajectory, with an estimated market size reaching several billion dollars by the end of the decade.

Government Incentives for Clean Technology

Government incentives aimed at promoting clean technology are significantly impacting the Automotive Emission Test Equipment Market. Various countries are offering subsidies and tax breaks to manufacturers that invest in environmentally friendly technologies, including emission testing equipment. These incentives encourage automotive companies to upgrade their testing capabilities to meet regulatory requirements and enhance their sustainability efforts. As a result, the market for emission test equipment is likely to see increased investment and innovation, fostering a competitive landscape. The potential for growth in this sector is substantial, as governments continue to prioritize environmental initiatives and support the transition towards cleaner automotive technologies.

Technological Innovations in Testing Equipment

Technological advancements play a pivotal role in shaping the Automotive Emission Test Equipment Market. Innovations such as real-time emission monitoring systems and portable testing devices are revolutionizing the way emissions are measured. These technologies not only enhance accuracy but also improve the efficiency of testing processes. The integration of artificial intelligence and machine learning in testing equipment is expected to further streamline operations and provide deeper insights into vehicle emissions. As manufacturers seek to adopt these cutting-edge technologies, the market is projected to expand significantly, with a compound annual growth rate (CAGR) of over 5% anticipated in the coming years.