Enhanced Safety Standards

The Global Efuse Market for Automotive Application Industry is significantly influenced by the implementation of enhanced safety standards in the automotive sector. Regulatory bodies are increasingly mandating the use of advanced safety features, including efuses, to prevent electrical failures and potential hazards. This regulatory push not only ensures consumer safety but also drives manufacturers to adopt efuses in their designs. As a result, the market is expected to grow, with projections indicating a value of 1467.9 USD Million by 2035. The emphasis on safety is likely to propel the adoption of efuses across various vehicle types.

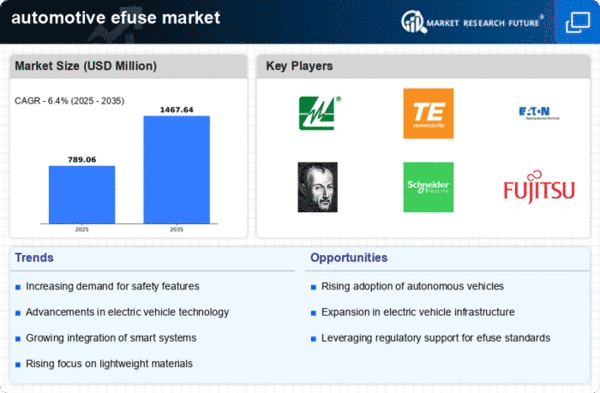

Market Growth Projections

The Global Efuse Market for Automotive Application Industry is poised for substantial growth, with projections indicating a market value of 741.6 USD Million in 2024 and an anticipated increase to 1467.9 USD Million by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.4% from 2025 to 2035, reflecting the increasing adoption of efuses in automotive applications. The market dynamics are influenced by various factors, including the rising demand for electric vehicles, enhanced safety standards, and technological advancements in automotive electronics. These elements collectively contribute to a robust outlook for the efuse market.

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Global Efuse Market for Automotive Application Industry. As governments worldwide implement stricter emissions regulations and provide incentives for EV purchases, the demand for efuses, which enhance the safety and reliability of electric systems, is expected to surge. In 2024, the market is projected to reach 741.6 USD Million, reflecting the growing need for advanced electrical components in EVs. This trend is likely to continue, with the market anticipated to expand significantly as more consumers transition to electric mobility.

Consumer Awareness of Electrical Safety

Consumer awareness regarding electrical safety in vehicles is becoming a significant driver for the Global Efuse Market for Automotive Application Industry. As consumers become more informed about the risks associated with electrical failures, they are increasingly demanding vehicles equipped with advanced safety features, including efuses. This heightened awareness is prompting manufacturers to prioritize the integration of efuses in their designs. Consequently, the market is expected to experience substantial growth, with projections indicating a value of 1467.9 USD Million by 2035. The shift in consumer preferences is likely to influence automotive design and production strategies.

Growing Focus on Vehicle Electrification

The Global Efuse Market for Automotive Application Industry is experiencing growth due to the increasing focus on vehicle electrification. As traditional internal combustion engines are gradually phased out, automakers are investing heavily in electric and hybrid vehicles. Efuses play a crucial role in managing the electrical systems of these vehicles, ensuring optimal performance and safety. The market is projected to reach 741.6 USD Million in 2024, driven by this shift towards electrification. The trend suggests that as more manufacturers embrace electric technologies, the demand for efuses will likely continue to rise.

Technological Advancements in Automotive Electronics

Technological advancements in automotive electronics are propelling the Global Efuse Market for Automotive Application Industry forward. Innovations such as smart efuses, which offer real-time monitoring and diagnostics, are becoming increasingly prevalent. These advancements not only improve vehicle performance but also enhance safety and reliability. As automotive manufacturers seek to integrate more sophisticated electronic systems, the demand for efuses is expected to rise. This trend aligns with the projected compound annual growth rate (CAGR) of 6.4% from 2025 to 2035, indicating a robust growth trajectory for the efuse market.