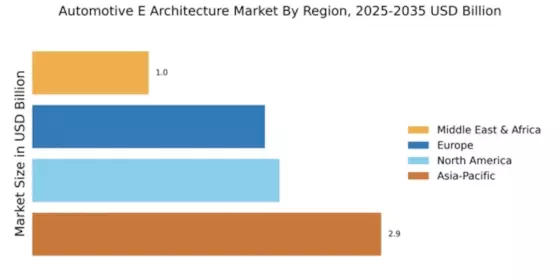

North America : Technological Innovation Leader

North America is poised for significant growth in the Automotive E Architecture Market, projected at $2.04B by December 2025. Key drivers include the increasing demand for advanced driver-assistance systems (ADAS) and the push for electric vehicles (EVs). Regulatory support for emissions reduction and safety standards further catalyzes market expansion. The region's focus on innovation and technology adoption is expected to enhance its market share, contributing to a robust automotive ecosystem. The competitive landscape in North America is dominated by major players such as Robert Bosch GmbH, Denso Corporation, and Texas Instruments. The U.S. leads the market, driven by substantial investments in R&D and a strong automotive manufacturing base. Companies are increasingly collaborating with tech firms to integrate cutting-edge technologies into vehicles, ensuring they remain competitive in a rapidly evolving market.

Europe : Sustainability and Innovation Hub

Europe's Automotive E Architecture Market is projected to reach $1.92B by December 2025, driven by stringent regulations aimed at reducing carbon emissions and enhancing vehicle safety. The European Union's Green Deal and various national initiatives are pivotal in promoting electric mobility and sustainable automotive solutions. This regulatory framework is expected to significantly boost market demand, positioning Europe as a leader in automotive innovation. Leading countries in this region include Germany, France, and the Netherlands, where key players like Continental AG and Infineon Technologies AG are actively investing in R&D. The competitive landscape is characterized by a strong emphasis on sustainability, with companies focusing on developing energy-efficient technologies. Collaborations between automotive manufacturers and tech firms are increasingly common, enhancing the region's market position.

Asia-Pacific : Emerging Powerhouse in Automotive

Asia-Pacific is the largest market for Automotive E Architecture, projected to reach $2.88B by December 2025. The region's growth is driven by rising vehicle production, increasing consumer demand for advanced features, and government initiatives promoting electric vehicles. Countries like China and Japan are at the forefront, with significant investments in automotive technology and infrastructure, further enhancing market dynamics. China, as the leading country in this region, is home to numerous key players, including Denso Corporation and NXP Semiconductors. The competitive landscape is marked by rapid technological advancements and a focus on smart mobility solutions. The presence of major automotive manufacturers and a growing number of startups in the EV sector contribute to a vibrant ecosystem, positioning Asia-Pacific as a critical player in the global market.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region is projected to reach $0.96B in the Automotive E Architecture Market by December 2025. The growth is primarily driven by increasing vehicle ownership, urbanization, and government initiatives aimed at enhancing transportation infrastructure. The region's focus on diversifying economies and investing in technology is expected to create new opportunities in the automotive sector, albeit at a slower pace compared to other regions. Leading countries such as South Africa and the UAE are making strides in automotive innovation, with key players like Harman International and Valeo SA establishing a presence. The competitive landscape is evolving, with local manufacturers increasingly collaborating with international firms to enhance their technological capabilities. This collaboration is essential for meeting the growing demand for advanced automotive solutions in the region.