Rising Vehicle Production

The increasing production of vehicles is a primary driver for the Automotive Door Sill Market. As manufacturers ramp up output to meet consumer demand, the need for various components, including door sills, escalates. In recent years, vehicle production has shown a steady growth trajectory, with millions of units produced annually. This trend is expected to continue, as automotive companies invest in new models and technologies. Consequently, the Automotive Door Sill Market is likely to experience a corresponding rise in demand, as these components are essential for both functionality and aesthetics in modern vehicles.

Increased Focus on Safety Features

Safety remains a paramount concern in the automotive sector, influencing the Automotive Door Sill Market. Door sills play a crucial role in vehicle safety, providing structural integrity and protection during collisions. As regulatory standards become more stringent, manufacturers are compelled to enhance the safety features of their vehicles, including door sills. This focus on safety is reflected in market trends, where products that meet or exceed safety regulations are increasingly favored. Consequently, the demand for high-quality, safety-oriented door sills is likely to rise, further propelling the Automotive Door Sill Market.

Expansion of Electric Vehicle Segment

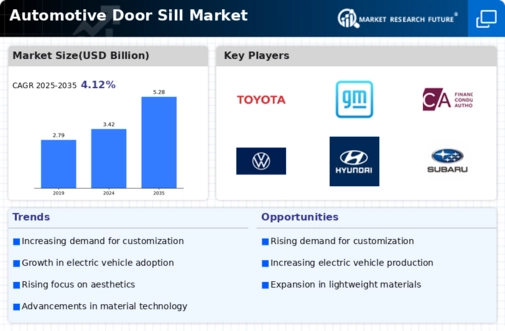

The rise of electric vehicles (EVs) is reshaping the Automotive Door Sill Market. As more consumers opt for EVs, manufacturers are adapting their designs to accommodate the unique requirements of these vehicles. Door sills in electric vehicles often incorporate advanced features such as integrated charging ports and enhanced insulation. Market data indicates that the EV segment is growing rapidly, with projections suggesting that a significant percentage of new vehicle sales will be electric in the coming years. This shift presents a substantial opportunity for the Automotive Door Sill Market, as manufacturers innovate to meet the demands of this evolving market.

Technological Advancements in Materials

The Automotive Door Sill Market is benefiting from advancements in materials technology. Innovations such as lightweight composites and durable plastics are being integrated into door sill designs, enhancing performance and longevity. These materials not only improve the functionality of door sills but also contribute to overall vehicle efficiency by reducing weight. Market data suggests that the adoption of advanced materials is on the rise, with manufacturers increasingly prioritizing these innovations in their production processes. This trend is expected to bolster the Automotive Door Sill Market, as companies seek to differentiate their products through superior material choices.

Growing Consumer Preference for Aesthetics

Consumer preferences are shifting towards vehicles that not only perform well but also exhibit high aesthetic value. The Automotive Door Sill Market is significantly influenced by this trend, as door sills contribute to the overall look and feel of a vehicle's interior and exterior. Manufacturers are increasingly focusing on design elements, materials, and finishes that appeal to consumers. This shift is reflected in market data, which indicates that aesthetically pleasing vehicles tend to command higher prices. As a result, the demand for stylish and innovative door sills is likely to grow, driving the Automotive Door Sill Market forward.