Rising Demand for Electric Vehicles

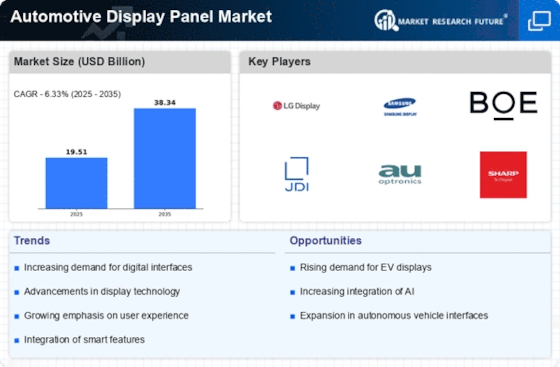

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Display Panel Market. As consumers become more environmentally conscious, the demand for EVs has surged, leading to a corresponding need for advanced display panels that provide essential information and enhance user experience. In 2025, it is estimated that the EV market will account for approximately 30% of total vehicle sales, necessitating sophisticated display technologies. These panels not only serve functional purposes but also contribute to the aesthetic appeal of EVs, making them a crucial component in attracting buyers. The integration of high-resolution screens and interactive interfaces in EVs is likely to further propel the Automotive Display Panel Market, as manufacturers seek to differentiate their offerings in a competitive landscape.

Consumer Preference for Enhanced In-Car Experience

Consumer preferences are shifting towards a more enhanced in-car experience, driving demand in the Automotive Display Panel Market. As vehicles evolve into mobile entertainment hubs, the need for high-quality display panels that support multimedia content is becoming increasingly important. By 2025, it is projected that the in-car entertainment market will exceed 20 billion dollars, underscoring the role of display technologies in this transformation. Features such as touchscreens, voice recognition, and connectivity with personal devices are becoming standard expectations among consumers. This trend indicates that automotive manufacturers must prioritize the integration of advanced display solutions to meet consumer demands, thereby fostering growth in the Automotive Display Panel Market.

Technological Advancements in Display Technologies

Technological innovations in display technologies are significantly influencing the Automotive Display Panel Market. The advent of OLED and LCD technologies has transformed the way information is presented in vehicles, offering superior image quality and energy efficiency. As of 2025, the market for OLED displays in automotive applications is projected to grow at a compound annual growth rate of over 15%. These advancements enable manufacturers to create more vibrant and responsive displays, enhancing the overall driving experience. Furthermore, the integration of augmented reality (AR) and heads-up displays (HUDs) is becoming increasingly prevalent, providing drivers with critical information without diverting their attention from the road. This trend indicates a shift towards more interactive and user-friendly interfaces, which are essential for modern vehicles.

Regulatory Support for Advanced Display Technologies

Regulatory frameworks are increasingly supporting the adoption of advanced display technologies in the Automotive Display Panel Market. Governments are implementing policies that encourage the integration of innovative safety and infotainment systems in vehicles. As of 2025, various regions are expected to introduce regulations that mandate the inclusion of certain display features, such as rearview cameras and navigation systems, in new vehicles. This regulatory push is likely to stimulate demand for high-quality display panels that comply with these standards. Additionally, incentives for manufacturers to invest in research and development of cutting-edge display technologies may further enhance the competitive landscape of the Automotive Display Panel Market, driving innovation and growth.

Increasing Focus on Driver Safety and Assistance Systems

The growing emphasis on driver safety and advanced driver assistance systems (ADAS) is a significant driver for the Automotive Display Panel Market. As safety regulations become more stringent, automotive manufacturers are incorporating advanced display panels that provide real-time data and alerts to drivers. In 2025, it is anticipated that the market for ADAS will reach a valuation of over 50 billion dollars, highlighting the importance of display technologies in these systems. Display panels serve as critical interfaces for conveying information related to navigation, collision warnings, and lane-keeping assistance. This trend not only enhances safety but also improves the overall user experience, making sophisticated display solutions indispensable in modern vehicles.