Increase in Automotive Production

The automotive diode market appears to be positively influenced by the increase in automotive production. As manufacturers ramp up production to meet consumer demand, the need for reliable electronic components, including diodes, becomes paramount. In 2025, the automotive production is projected to reach approximately 90 million units, which indicates a robust demand for automotive diodes. These components are essential for various applications, such as power management and signal processing, thereby driving the market forward. The automotive diode market is likely to benefit from this trend, as manufacturers seek to enhance vehicle performance and efficiency through advanced electronic systems.

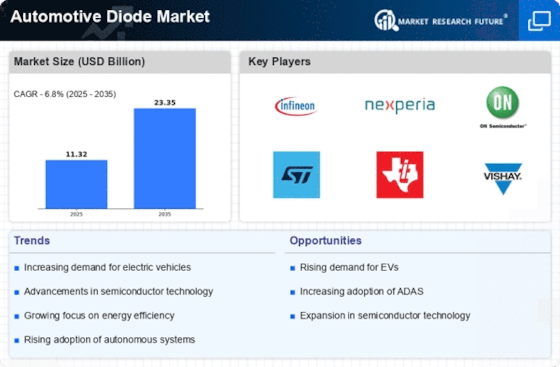

Shift Towards Electrification of Vehicles

The automotive diode market is significantly impacted by the shift towards electrification of vehicles. With the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), the demand for efficient power management systems is on the rise. Diodes play a critical role in these systems, facilitating energy conversion and management. In 2025, the EV market is projected to account for over 25% of total vehicle sales, which suggests a growing need for automotive diodes. This trend indicates that the automotive diode market is poised for growth as manufacturers adapt to the electrification trend.

Technological Innovations in Semiconductor Materials

The automotive diode market is being driven by technological innovations in semiconductor materials. Advances in materials such as silicon carbide (SiC) and gallium nitride (GaN) are enhancing the performance of diodes, making them more efficient and reliable. These innovations are particularly relevant in high-power applications, which are increasingly prevalent in modern vehicles. As of 2025, the market for SiC and GaN diodes is expected to grow significantly, indicating a shift towards more advanced semiconductor technologies. This trend suggests that the automotive diode market will evolve as manufacturers adopt these new materials to improve vehicle performance and energy efficiency.

Rising Focus on Fuel Efficiency and Emission Reduction

The automotive diode market is likely to benefit from the rising focus on fuel efficiency and emission reduction. As regulatory bodies impose stricter emission standards, automakers are compelled to innovate and enhance vehicle efficiency. Diodes are integral to various electronic systems that optimize engine performance and reduce fuel consumption. In 2025, the automotive industry is expected to invest heavily in technologies that improve fuel efficiency, which could lead to an increased demand for automotive diodes. This trend suggests that the automotive diode market will continue to grow as manufacturers seek to comply with environmental regulations.

Growing Demand for Advanced Driver Assistance Systems (ADAS)

The automotive diode market is experiencing growth due to the increasing demand for advanced driver assistance systems (ADAS). These systems, which enhance vehicle safety and convenience, rely heavily on electronic components, including diodes. As of 2025, the market for ADAS is expected to surpass 30 billion USD, indicating a substantial opportunity for diode manufacturers. The integration of diodes in these systems is crucial for functions such as sensor data processing and communication between vehicle components. Consequently, the automotive diode market is likely to expand as automakers invest in innovative safety technologies.