Market Share

Automotive Differential System Market Share Analysis

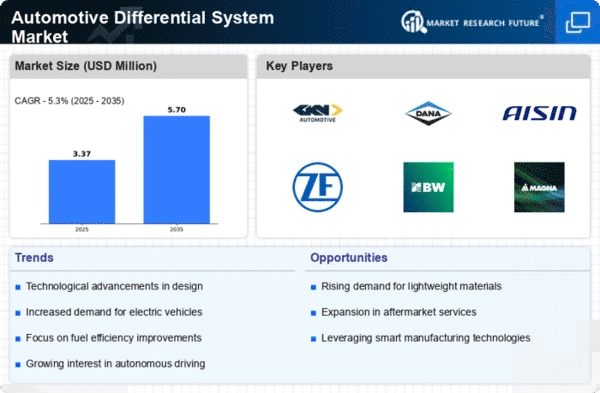

The Automotive Differential System Market is undergoing significant trends, reflecting the constant evolution of the automotive industry toward improved performance, efficiency, and advanced drivetrain technologies. One key trend in this market is the growing demand for electronic limited-slip differentials (eLSDs) and advanced torque vectoring systems. As automotive enthusiasts seek enhanced vehicle dynamics and handling performance, manufacturers are incorporating electronic controls to manage torque distribution between the wheels. This not only improves traction and stability but also enhances overall driving experience, particularly in high-performance and off-road vehicles.

Moreover, the market is witnessing a shift towards electric and hybrid vehicles, influencing trends in automotive differential systems. Unlike traditional internal combustion engines, electric powertrains deliver instantaneous torque to the wheels, necessitating sophisticated differential systems. Electric vehicles (EVs) often utilize electronic differential controls to manage power distribution between the individual electric motors, optimizing traction and efficiency. This trend aligns with the broader industry push towards electrification and the integration of advanced drivetrain technologies in next-generation vehicles.

Another noteworthy trend is the increasing focus on lightweight and compact differential designs. Automakers are exploring innovative materials and manufacturing techniques to reduce the weight and size of differential systems. Lighter differentials contribute to overall vehicle weight reduction, improving fuel efficiency and handling characteristics. Additionally, compact designs allow for more flexibility in vehicle packaging, enabling automakers to optimize interior space and meet design requirements without compromising performance.

Furthermore, the market is responding to the demand for all-wheel-drive (AWD) and four-wheel-drive (4WD) systems across various vehicle segments. Consumers are increasingly seeking vehicles with enhanced off-road capabilities, and differential systems play a crucial role in providing power to all wheels, improving traction in challenging terrains. This trend is not limited to traditional off-road vehicles but extends to SUVs, crossovers, and even electric or hybrid models, as automakers aim to offer diverse drivetrain options to meet consumer preferences.

Additionally, the integration of advanced sensor technologies and connectivity features is shaping trends in the automotive differential system market. Sensors, such as wheel speed sensors and accelerometers, provide real-time data to the vehicle's control systems, enabling precise management of differential functions. Connectivity features allow for seamless communication between different components of the vehicle's drivetrain, enhancing overall performance and safety. This trend aligns with the broader industry shift towards smart and connected vehicles, where data-driven technologies play a central role in optimizing various vehicle systems.

In conclusion, the Automotive Differential System Market is witnessing transformative trends driven by the industry's pursuit of enhanced performance, electrification, lightweight designs, off-road capabilities, and connectivity. The adoption of electronic limited-slip differentials, advancements in torque vectoring systems, lightweight and compact designs, and the integration of sensor technologies are shaping the evolution of differential systems in modern vehicles. As the automotive landscape continues to evolve, differential systems remain a critical component in delivering optimal traction, stability, and performance across a wide range of vehicle types and driving conditions.

Leave a Comment