Market Analysis

In-depth Analysis of Automotive Differential System Market Industry Landscape

The Automotive Differential System market is shaped by a variety of market factors that collectively influence its growth and dynamics. One of the primary drivers for this market is the increasing demand for improved vehicle performance and handling. The differential system plays a crucial role in distributing power between the wheels, enabling smooth turns and preventing wheel slippage. As consumer preferences evolve towards vehicles with enhanced driving dynamics, automakers are focusing on advanced differential systems to optimize traction, stability, and overall driving experience.

Technological advancements are pivotal in shaping the Automotive Differential System market. Ongoing research and development efforts focus on enhancing the efficiency, durability, and functionality of differential systems. Innovations such as electronic limited-slip differentials (eLSDs), torque vectoring systems, and advancements in gear and bearing technologies contribute to the market's evolution. Manufacturers strive to develop differential systems that not only meet performance expectations but also address fuel efficiency and emission reduction goals.

Market factors are closely tied to broader automotive industry trends. As the automotive landscape undergoes transformations, with a shift towards electric and hybrid vehicles, the role of differential systems in optimizing power distribution becomes even more critical. The market is adapting to these changes by developing differential solutions tailored to the specific needs of electric and hybrid drivetrains, contributing to the overall efficiency and performance of alternative powertrain vehicles.

The regulatory environment significantly influences the Automotive Differential System market. Emission standards and safety regulations drive the adoption of advanced drivetrain technologies, including differential systems. Compliance with these regulations is essential for automakers to ensure that their vehicles meet the necessary environmental and safety standards. As regulations evolve, the demand for innovative differential systems that contribute to both performance and compliance is expected to grow.

Economic conditions and consumer purchasing power are essential factors influencing the Automotive Differential System market. Economic downturns may lead to a temporary slowdown in new vehicle purchases, impacting the demand for advanced drivetrain technologies. Conversely, economic growth, increasing disposable income, and a thriving automotive sector contribute to the widespread integration of advanced differential systems, especially in performance and luxury vehicle segments.

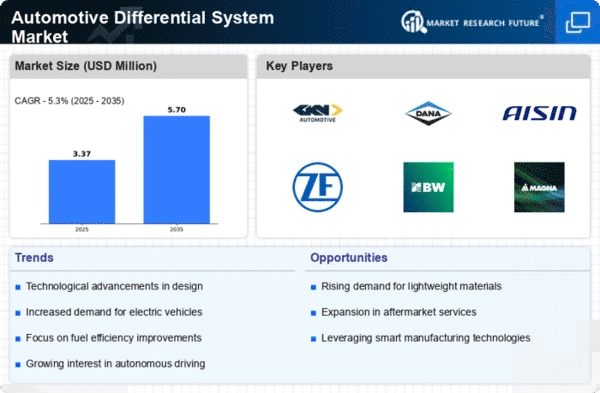

Competitive dynamics and the presence of key market players play a crucial role in shaping the Automotive Differential System market. The industry is characterized by intense competition among manufacturers, each striving to differentiate themselves through technological innovation, cost-effectiveness, and reliability. Strategic collaborations, partnerships, and mergers contribute to market consolidation and the development of advanced differential solutions.

Environmental considerations and the global push towards sustainability also impact the market. As the automotive industry seeks to reduce its environmental footprint, advanced differential systems that contribute to fuel efficiency and emissions reduction gain prominence. Manufacturers are focusing on developing solutions that not only enhance vehicle performance but also align with the broader trend of adopting eco-friendly technologies.

The evolution of vehicle designs and the integration of autonomous and semi-autonomous driving features are additional factors influencing the Automotive Differential System market. As vehicles become more advanced and capable of autonomous functions, differential systems need to adapt to changing driving scenarios. Innovations in adaptive differential technologies and their integration with autonomous driving systems contribute to the market's evolution.

Supply chain dynamics and the availability of raw materials also impact the Automotive Differential System market. Manufacturers need to ensure a stable supply of materials for producing differential components. Any disruptions in the supply chain can affect production schedules and the availability of vehicles equipped with advanced differential systems.

In conclusion, the Automotive Differential System market is influenced by a combination of technological, regulatory, economic, competitive, and environmental factors. As the automotive industry continues to focus on performance, efficiency, and sustainability, differential systems play a crucial role in meeting these evolving demands. The market is expected to witness further advancements as manufacturers strive to develop innovative differential solutions that cater to the changing landscape of the automotive sector.

Leave a Comment