Stringent Emission Regulations

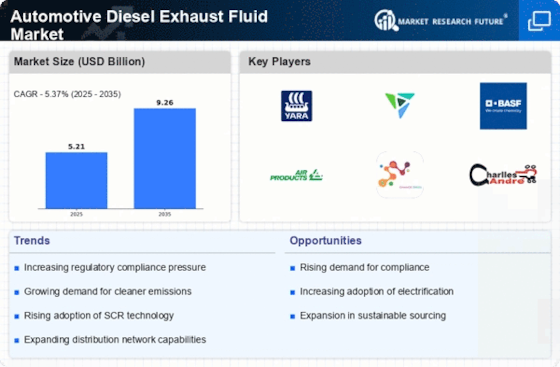

The Automotive Diesel Exhaust Fluid Market is significantly influenced by stringent emission regulations imposed by various governments. These regulations aim to mitigate environmental pollution and promote cleaner air quality. As a result, the adoption of diesel exhaust fluid has become a necessity for diesel engine operators to comply with these standards. The introduction of regulations such as Euro 6 in Europe and similar initiatives in other regions has led to an increased focus on reducing harmful emissions. Consequently, the demand for diesel exhaust fluid is expected to grow, as it plays a crucial role in the selective catalytic reduction process, which is essential for meeting these regulatory requirements. This regulatory landscape is likely to drive the Automotive Diesel Exhaust Fluid Market forward, as stakeholders seek solutions to adhere to compliance mandates.

Expansion of the Automotive Sector

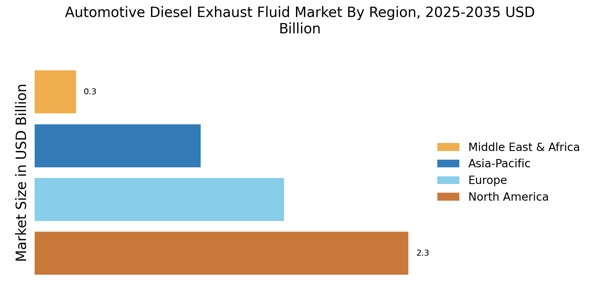

The Automotive Diesel Exhaust Fluid Market is poised for growth due to the expansion of the automotive sector, particularly in emerging markets. As economies develop and disposable incomes rise, there is an increasing demand for vehicles, including diesel-powered options. This trend is particularly evident in regions where diesel engines are preferred for their fuel efficiency and longevity. The expansion of infrastructure and logistics networks further supports the growth of diesel vehicles, thereby increasing the need for diesel exhaust fluid. As a result, the Automotive Diesel Exhaust Fluid Market is likely to benefit from this upward trajectory, as manufacturers and suppliers work to meet the rising demand for diesel exhaust fluid in tandem with the growing automotive sector.

Increasing Demand for Diesel Vehicles

The Automotive Diesel Exhaust Fluid Market is experiencing a notable surge in demand for diesel vehicles, driven by their superior fuel efficiency and torque characteristics. Diesel engines are often favored in commercial applications, such as freight transport and construction, where performance and durability are paramount. As a result, the need for diesel exhaust fluid, which is essential for reducing nitrogen oxide emissions, is expected to rise. According to recent data, the diesel vehicle segment is projected to account for a significant share of the automotive market, further propelling the demand for diesel exhaust fluid. This trend indicates a robust growth trajectory for the Automotive Diesel Exhaust Fluid Market, as manufacturers and consumers alike prioritize compliance with stringent emission regulations.

Rising Awareness of Environmental Issues

The Automotive Diesel Exhaust Fluid Market is increasingly shaped by rising awareness of environmental issues among consumers and businesses. As public concern over air quality and climate change intensifies, there is a growing emphasis on sustainable practices within the automotive sector. This shift in consumer behavior is prompting manufacturers to prioritize the use of diesel exhaust fluid, which is essential for reducing harmful emissions from diesel engines. The increasing adoption of eco-friendly practices is likely to drive demand for diesel vehicles equipped with advanced emission control technologies. Consequently, the Automotive Diesel Exhaust Fluid Market is expected to expand, as stakeholders recognize the importance of aligning with environmentally conscious consumer preferences.

Technological Innovations in Fluid Production

The Automotive Diesel Exhaust Fluid Market is benefiting from technological innovations in the production of diesel exhaust fluid. Advances in manufacturing processes and quality control have led to the development of higher purity fluids, which enhance the efficiency of the selective catalytic reduction systems in diesel engines. These innovations not only improve the performance of diesel vehicles but also ensure that the fluid meets the stringent quality standards set by regulatory bodies. Furthermore, the integration of automation and smart technologies in production facilities is streamlining operations, reducing costs, and increasing output. As a result, the Automotive Diesel Exhaust Fluid Market is poised for growth, as manufacturers can meet the rising demand for high-quality diesel exhaust fluid more effectively.