Market Share

Automotive Diagnostic Scan Tools Market Share Analysis

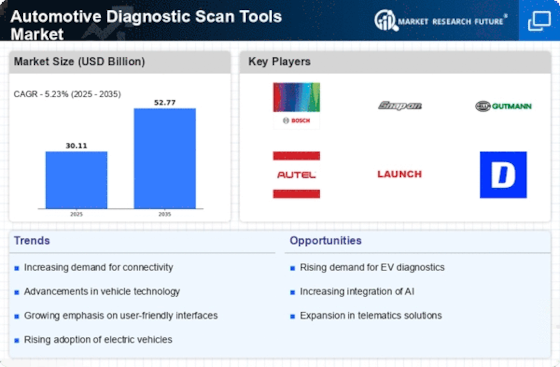

Scarce skilled manpower, mainly in third world and developing countries as well as the high cost of equipments are the major limiting factors of the Automotive Diagnostic Tool Market. With the proliferation of contemporary diagnostic scan tools, such tools tend to end up with having a plethora of functionalities that they can perform ranging from basic to high complex coding while carrying on chassis, powertrain, and body diagnostics. These tools are commonly found in passenger vehicles and a wide range of machinery like heavy commercial vehicles, agricultural and off-road vehicles. The market for automotive diagnostic scan tools witnesses the numerous turns of events, which are the emergence of modern technologies as well as the changed automotive industry. A noticeable trend in this market is migration of connected diagnostic tools to the point of diagnosis. These tools utilize any of the connecting features including Wi-Fi, Bluetooth, as well as cellular networks that facilitate communication between devices such as smartphones, tablets, and cloud systems with the scanners. This development lends support to remote diagnosis, data transmission in real-time, and software updates which leads to better human diagnostics performance and opportunities.

Moreover, the utilization of advanced technologies like AI and ML alongside with the rise of diagnostic tools is gradually changing the shape of the diagnostic medical equipment. AI-driven diagnostic tools can analyze huge amounts of data from cars, pinpoint patterns and generate more precise and time-saving diagnostics compared to those done, driven by artificial intelligence. By using ML algorithms, the diagnostic tools will continually be retrained with new sets of data and be enhancing their diagnostic abilities, which will result to higher accuracy and less errors. AI and ML usage in automotive diagnostics falls under the category of a disruptive transition towards smart and effective diagnostics.

In addition the trend is more and more toward wide functionality of multi-brand and multi-system diagnostic capabilities in scan tools. The carmakers are manufacturing cars with electronics systems which are distinctively complex, thus, there is a need for diagnostic tools that can run diagnostics on various systems of the car and also across multiple brands of the vehicular motor manufacturers which is a complex task. It serves the purpose where there is a requirement for a versatile diagnostic tool that can diagnose a variety of vehicles and the ever-increasing complex electronic components.

In addition, emergence of electric cars and hybrid vehicles is one of the trends that is determining the future of automotive diagnostic scan tools market. The vehicles with their in-house built systems and parts like battery management systems and electric drivetrains, demand a diagnostic capability exclusively tailored to them. Gadgets with the ability to diagnosis electric and hybrid cars are gaining prominence and as such we the technician can nab these problems before they become bigger and therefore are trend towards specialized diagnostic troubleshooting for new fuel vehicles.

Leave a Comment