Weight Reduction in Vehicles

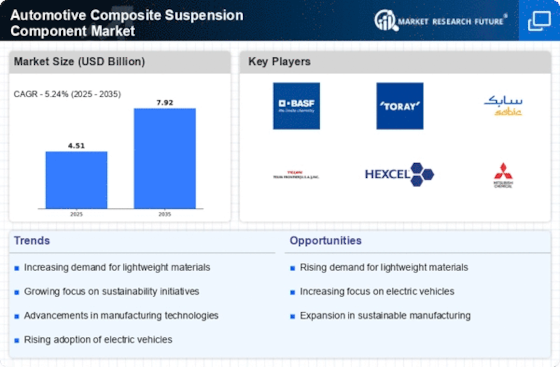

The Automotive Composite Suspension Component Market is experiencing a notable shift towards weight reduction in vehicles. As manufacturers strive to enhance fuel efficiency and reduce emissions, the demand for lightweight materials has surged. Composites, known for their high strength-to-weight ratio, are increasingly being integrated into suspension systems. This trend is supported by data indicating that a 10% reduction in vehicle weight can lead to a 6-8% improvement in fuel economy. Consequently, the adoption of composite materials in suspension components is likely to accelerate, as automakers seek to meet stringent environmental regulations and consumer expectations for sustainability.

Growing Electric Vehicle Adoption

The Automotive Composite Suspension Component Market is significantly influenced by the rising adoption of electric vehicles (EVs). As the automotive landscape shifts towards electrification, manufacturers are seeking innovative solutions to optimize vehicle performance and efficiency. Composites play a crucial role in this transition, as they contribute to weight reduction and enhance the overall driving experience. Data indicates that the EV market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to drive demand for advanced composite suspension components, as automakers aim to improve the range and performance of electric vehicles.

Enhanced Performance Characteristics

In the Automotive Composite Suspension Component Market, the performance characteristics of composite materials are becoming a pivotal driver. Composites offer superior fatigue resistance, corrosion resistance, and improved damping properties compared to traditional materials. This enhancement in performance is particularly crucial for high-performance vehicles, where handling and ride quality are paramount. Market data suggests that the use of composite materials can improve the lifespan of suspension components by up to 30%, thereby reducing maintenance costs for consumers. As a result, the automotive industry is increasingly investing in composite technologies to leverage these performance benefits.

Innovations in Manufacturing Processes

Innovations in manufacturing processes are playing a crucial role in the Automotive Composite Suspension Component Market. Advances such as automated fiber placement and resin transfer molding are enhancing the efficiency and scalability of composite production. These technologies not only reduce production time but also improve the consistency and quality of the final products. As manufacturers adopt these innovative processes, the cost of composite components is expected to decrease, making them more accessible to a broader range of automotive applications. This trend is likely to stimulate further investment in composite suspension systems, aligning with the industry's push for advanced materials.

Cost-Effectiveness of Composite Materials

Cost-effectiveness is emerging as a significant driver in the Automotive Composite Suspension Component Market. While the initial investment in composite materials may be higher than traditional metals, the long-term benefits often outweigh these costs. Composites can lead to reduced manufacturing and maintenance expenses due to their durability and lower weight. Market analysis reveals that the lifecycle cost of vehicles utilizing composite suspension components can be lower by approximately 15-20% compared to those using conventional materials. This economic advantage is prompting manufacturers to explore composite solutions as a viable alternative, thereby fostering growth in the market.