Diverse Applications

Diverse applications of carbon fiber composites are driving growth in the Automotive Carbon Fiber Composites Part Market. These materials are not limited to high-end sports cars; they are increasingly being utilized in mainstream vehicles, electric vehicles, and even commercial transport. The versatility of carbon fiber composites allows for their use in various automotive components, including structural parts, interior elements, and exterior panels. As the automotive industry evolves, the demand for lightweight and durable materials is expected to rise, with carbon fiber composites playing a central role. By 2025, the market is projected to expand as manufacturers explore new applications, further solidifying the position of carbon fiber composites in the automotive sector.

Regulatory Compliance

Regulatory compliance is becoming a significant driver for the Automotive Carbon Fiber Composites Part Market. Governments worldwide are implementing stringent regulations aimed at reducing vehicle emissions and enhancing safety standards. In response, automotive manufacturers are increasingly turning to carbon fiber composites, which offer superior strength-to-weight ratios and can contribute to lighter vehicles. This shift is expected to accelerate in 2025, as compliance with these regulations becomes more critical. The automotive sector's focus on meeting safety and environmental standards is likely to propel the demand for carbon fiber composites, as they provide a viable solution to achieve these objectives while maintaining performance and efficiency.

Performance Enhancement

Performance enhancement is a key factor driving the Automotive Carbon Fiber Composites Part Market. The automotive industry is continuously seeking ways to improve vehicle performance, including acceleration, handling, and fuel efficiency. Carbon fiber composites are recognized for their lightweight properties, which can significantly reduce vehicle weight and improve overall performance. In 2025, the market is expected to witness a surge in demand for these materials, as manufacturers aim to produce high-performance vehicles that meet consumer expectations. The integration of carbon fiber components in critical areas such as chassis and body panels is likely to enhance vehicle dynamics, making them more appealing to performance-oriented consumers.

Technological Innovations

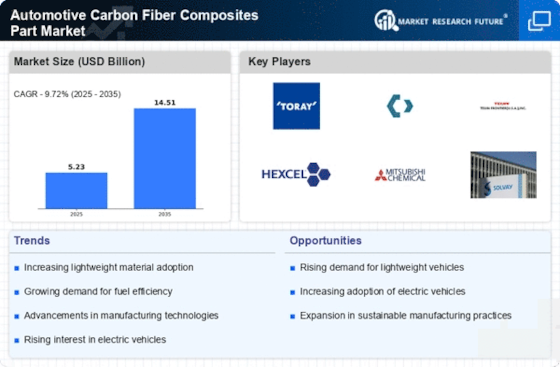

Technological innovations are a pivotal driver in the Automotive Carbon Fiber Composites Part Market. Advancements in manufacturing techniques, such as automated fiber placement and resin transfer molding, have enhanced the efficiency and cost-effectiveness of carbon fiber production. In 2025, the market is expected to benefit from these innovations, which allow for the creation of complex geometries and improved material properties. The introduction of new composite formulations that offer better performance characteristics is also anticipated to attract automotive manufacturers. As a result, the market for automotive carbon fiber composites is likely to expand, with an estimated growth rate of over 15% annually, reflecting the increasing adoption of these advanced materials in vehicle design.

Sustainability Initiatives

The Automotive Carbon Fiber Composites Part Market is increasingly influenced by sustainability initiatives. As manufacturers strive to reduce their carbon footprints, the demand for lightweight materials like carbon fiber composites is rising. These materials not only enhance fuel efficiency but also contribute to lower emissions. In 2025, the automotive sector is projected to see a significant shift towards sustainable practices, with carbon fiber composites playing a crucial role. The integration of these materials aligns with global efforts to promote eco-friendly manufacturing processes, thereby driving market growth. Furthermore, the increasing consumer preference for environmentally responsible vehicles is likely to bolster the demand for automotive carbon fiber composites, as manufacturers seek to meet these expectations.