Top Industry Leaders in the Automotive Battery Market

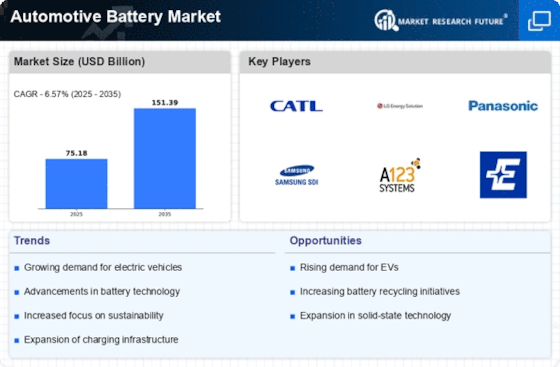

The landscape of the automotive battery market is experiencing a significant transformation, driven by the rapid ascent of electric vehicles (EVs). The era of lead-acid dominance is a thing of the past, as lithium-ion takes center stage, promising increased range and electrifying performance. This dynamic environment fosters fierce competition, with established industry leaders vying for position and new entrants seeking a foothold.

Strategies of Key Players: Pursuing Victory

- Exide

- GS Yuasa

- Panasonic

- LG Chem

- A123 Systems

- East Penn Manufacturing Company

- Robert Bosch Gm BH

- EnerSys, among others.

- Global Giants: Established players such as LG Chem, Panasonic, and Samsung SDI leverage their extensive experience, economies of scale, and research & development (R&D) capabilities to maintain their leadership. They prioritize forming partnerships with major automakers, securing long-term supply contracts, and optimizing battery design for specific vehicle platforms.

- Rising Stars: Chinese companies like Contemporary Amperex Technology Co. Ltd. (CATL) and BYD are rapidly expanding, capitalizing on government subsidies and cost-effective manufacturing. They concentrate on vertical integration, controlling raw material sourcing and production processes to offer competitive pricing and ensure supply security.

- Technological Trailblazers: Startups like Tesla and Fisker Automotive go beyond being battery suppliers; they are vertically integrated EV manufacturers. Their focus lies on battery innovation, exploring next-generation chemistries like solid-state batteries, and investing in recycling and second-life applications.

Market Share Analysis: Beyond Raw Numbers • Volume vs. Value: While giants like CATL lead in unit shipments, established players like LG Chem maintain a higher market share by value. This difference reflects their emphasis on supplying batteries for premium EVs with larger capacity and higher performance.

- Geographic Diversification: The market landscape varies significantly across regions. Europe presents lucrative opportunities with strict emissions regulations, while China leads in sheer volume due to government incentives. Understanding regional dynamics is crucial for strategic market entry and expansion.

- Technological Differentiation: Battery chemistry is a crucial differentiator. While lithium-nickel-manganese-cobalt-oxide (NMC) remains predominant, players are exploring alternatives like lithium-iron-phosphate (LFP) for cost-efficiency and thermal stability. Solid-state batteries, with promises of increased energy density and safety, are on the horizon and could disrupt the established order.

Emerging Trends: Shaping Tomorrow • Sustainability in the Spotlight: Environmental concerns are driving battery manufacturers toward responsible sourcing and ethical practices, including sustainable raw material extraction, reduced CO2 emissions in production, and closed-loop recycling systems.

- Software Intelligence: Batteries are evolving into more than just hardware; they are becoming increasingly software-integrated. Battery management systems (BMS) are evolving to optimize performance, extend lifespan, and enable predictive maintenance, creating new avenues for competition and collaboration.

- Second-Life Applications: As EV batteries reach the end of their vehicle life, opportunities emerge for repurposing them in stationary energy storage applications or grid balancing systems, creating a circular economy model for batteries and opening up new market segments.

The Competitive Landscape: A Dynamic Arena The automotive battery market is a dynamic and fragmented battlefield, with established players facing increasing pressure from disruptive newcomers. Technological advancements, evolving customer preferences, and regional policy landscapes are continually reshaping the competitive landscape. Winning players will need to combine scale and innovation, embrace sustainability, and adapt to ever-changing market dynamics. The race for EV battery dominance is far from over, and the next chapter promises to be even more electrifying.

Developments and Latest Updates:

- Exide Technologies: • December 12, 2023: Exide announces a strategic partnership with Charge CCCV to expand into the rapidly growing electric vehicle (EV) battery recycling market. (Source: Exide press release)

- GS Yuasa Corp: • December 15, 2023: GS Yuasa unveils a new high-performance lithium-ion battery specifically designed for hybrid electric vehicles (HEVs). (Source: GS Yuasa press release)

- LG Chem: • December 14, 2023: LG Chem and General Motors enter into a $5 billion partnership to establish a new battery cell manufacturing plant in the United States. (Source: GM press release)

- A123 Systems: • October 25, 2023: A123 Systems secures a new $1 billion contract from a major European automaker for the supply of lithium-ion battery packs for electric buses. (Source: A123 Systems press release)

- East Penn Manufacturing Company: • December 6, 2023: East Penn Manufacturing announces the expansion of its commercial battery production facility in Pennsylvania to meet the growing demand for fleet electrification. (Source: East Penn Manufacturing press release)