Government Regulations and Incentives

The Automotive AWD System Market is significantly influenced by government regulations and incentives aimed at promoting vehicle safety and environmental sustainability. Many regions are implementing stricter emissions standards and safety requirements, which compel manufacturers to adopt advanced AWD technologies. These regulations often come with incentives for consumers, such as tax breaks or rebates for purchasing vehicles equipped with efficient AWD systems. As of 2025, it is anticipated that these regulatory frameworks will continue to evolve, further driving the adoption of AWD systems that meet or exceed compliance standards. This regulatory environment not only fosters innovation within the Automotive AWD System Market but also encourages consumers to invest in vehicles that align with these standards, thereby enhancing market growth.

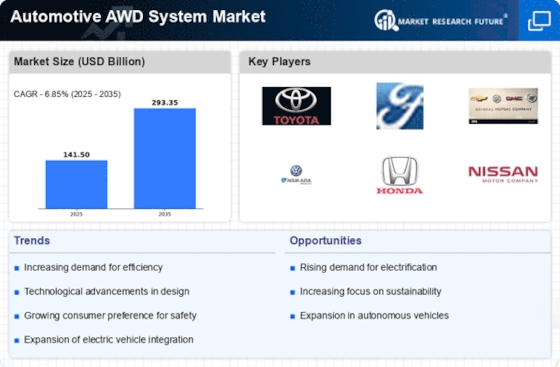

Increasing Demand for Fuel Efficiency

In the Automotive AWD System Market, the growing emphasis on fuel efficiency is a pivotal driver. Consumers are increasingly seeking vehicles that offer better fuel economy without compromising performance. AWD systems, traditionally associated with higher fuel consumption, are now being designed with efficiency in mind. Manufacturers are investing in lightweight materials and advanced engineering to create AWD systems that minimize energy loss. As of 2025, it is estimated that vehicles equipped with efficient AWD systems could see a reduction in fuel consumption by up to 15%. This shift not only meets consumer demands but also aligns with environmental regulations aimed at reducing carbon emissions. Consequently, the focus on fuel efficiency is likely to propel the growth of the Automotive AWD System Market, as manufacturers strive to balance performance with sustainability.

Technological Innovations in AWD Systems

The Automotive AWD System Market is experiencing a surge in technological innovations that enhance vehicle performance and safety. Advanced systems, such as torque vectoring and predictive algorithms, are being integrated into AWD systems, allowing for improved traction and handling. These innovations are not only appealing to consumers but also align with regulatory standards for vehicle safety and emissions. As of 2025, the market for advanced AWD systems is projected to grow significantly, driven by the demand for enhanced driving experiences. The incorporation of artificial intelligence and machine learning into AWD systems is likely to further revolutionize the industry, making vehicles smarter and more responsive to road conditions. This trend indicates a shift towards more sophisticated automotive technologies, which could redefine consumer expectations in the Automotive AWD System Market.

Rising Popularity of All-Terrain Vehicles

The Automotive AWD System Market is witnessing a notable increase in the popularity of all-terrain vehicles (ATVs) and off-road capable SUVs. This trend is driven by consumers' desire for versatility and adventure, leading to a higher demand for vehicles that can perform well in diverse conditions. AWD systems are essential for these vehicles, providing the necessary traction and stability on various terrains. As of 2025, the market for all-terrain vehicles is projected to expand, with a significant portion of this growth attributed to the enhanced capabilities offered by modern AWD systems. Manufacturers are responding to this trend by developing more robust and adaptable AWD technologies, which could further solidify their position in the Automotive AWD System Market. This increasing consumer interest in off-road capabilities suggests a shift in market dynamics, favoring vehicles that offer both utility and performance.

Shift Towards Electrification in the Automotive Sector

The Automotive AWD System Market is undergoing a transformation due to the shift towards electrification in the automotive sector. As electric and hybrid vehicles gain traction, the demand for AWD systems that can efficiently integrate with electric drivetrains is increasing. These systems are designed to optimize power distribution and enhance vehicle performance while maintaining energy efficiency. By 2025, it is projected that a substantial percentage of new vehicle sales will be electric or hybrid, necessitating the development of AWD systems tailored for these technologies. This shift not only presents challenges for manufacturers but also opportunities for innovation in the Automotive AWD System Market. The integration of AWD systems with electric vehicles could redefine performance standards and consumer expectations, potentially leading to a new era of automotive design and functionality.