Growth of Electric and Hybrid Vehicles

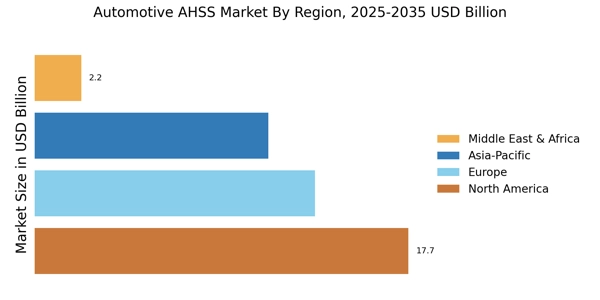

The rise of electric and hybrid vehicles is reshaping the Automotive AHSS Market. As automakers pivot towards electrification, the need for lightweight and durable materials becomes paramount. AHSS provides the necessary strength-to-weight ratio that supports the design of efficient electric vehicles, which require optimized weight for enhanced battery performance and range. In 2025, the market for electric vehicles is expected to expand, leading to increased utilization of AHSS in vehicle construction. This shift not only aligns with sustainability goals but also positions the Automotive AHSS Market as a key contributor to the future of transportation, where efficiency and performance are critical.

Regulatory Compliance and Safety Standards

The Automotive AHSS Market is significantly influenced by evolving regulatory compliance and safety standards. Governments worldwide are implementing stringent regulations aimed at enhancing vehicle safety and reducing environmental impact. The use of AHSS allows manufacturers to produce vehicles that meet these rigorous safety standards while maintaining structural integrity. In 2025, it is anticipated that the demand for AHSS will increase as automakers seek to comply with regulations that mandate higher crash safety ratings. This regulatory landscape not only drives innovation in material science but also positions the Automotive AHSS Market as a critical player in the automotive sector, as manufacturers prioritize safety and compliance.

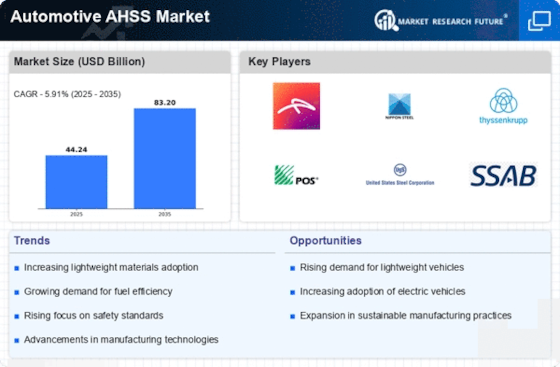

Increasing Demand for Lightweight Materials

The Automotive AHSS Market is experiencing a notable shift towards lightweight materials, driven by the need for improved fuel efficiency and reduced emissions. As manufacturers strive to meet stringent regulatory standards, the adoption of advanced high-strength steel (AHSS) has become increasingly prevalent. This material offers a compelling combination of strength and weight reduction, which is essential for enhancing vehicle performance. In 2025, the demand for lightweight materials is projected to grow significantly, with AHSS expected to account for a substantial share of the automotive materials market. This trend is further supported by consumer preferences for vehicles that are not only efficient but also environmentally friendly, thereby propelling the Automotive AHSS Market forward.

Consumer Preferences for Sustainable Vehicles

Consumer preferences are increasingly shifting towards sustainable vehicles, which is significantly impacting the Automotive AHSS Market. As awareness of environmental issues grows, consumers are more inclined to choose vehicles that utilize sustainable materials and manufacturing processes. AHSS, known for its recyclability and lower carbon footprint compared to traditional materials, aligns well with these consumer preferences. In 2025, it is projected that the demand for vehicles made with sustainable materials will rise, further driving the adoption of AHSS in the automotive sector. This trend not only reflects changing consumer values but also highlights the Automotive AHSS Market's role in promoting sustainability within the automotive landscape.

Technological Innovations in Steel Production

Technological advancements in steel production are playing a pivotal role in the Automotive AHSS Market. Innovations such as advanced manufacturing techniques and improved alloy compositions are enhancing the properties of AHSS, making it more appealing to automotive manufacturers. These advancements allow for the production of AHSS that is not only stronger but also more cost-effective. In 2025, it is expected that these technological innovations will lead to a broader adoption of AHSS in vehicle manufacturing, as companies seek to leverage the benefits of enhanced performance and reduced costs. This trend underscores the importance of continuous research and development within the Automotive AHSS Market.