Rising Fuel Prices

The Automotive Aftermarket Fuel Additive Market is experiencing a surge in demand due to rising fuel prices. As consumers seek ways to enhance fuel efficiency and reduce costs, fuel additives become increasingly appealing. Reports indicate that the average price of gasoline has seen a steady increase, prompting vehicle owners to explore solutions that can optimize fuel consumption. This trend is likely to drive the sales of fuel additives, as they promise improved mileage and performance. Furthermore, the economic pressures associated with fluctuating fuel prices may lead consumers to invest in aftermarket solutions that offer long-term savings. Consequently, the Automotive Aftermarket Fuel Additive Market is poised for growth as more individuals prioritize cost-effective measures in their vehicle maintenance routines.

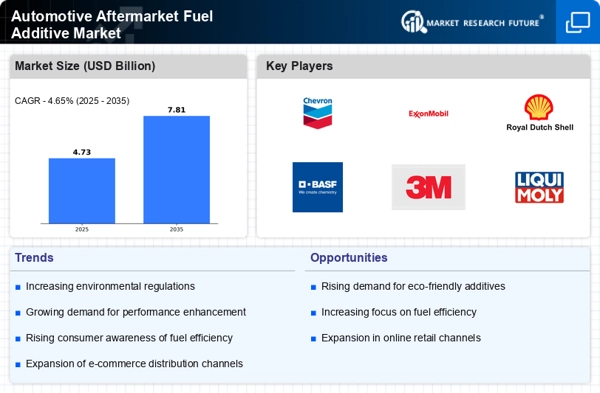

Environmental Regulations

The Automotive Aftermarket Fuel Additive Market is influenced by stringent environmental regulations aimed at reducing emissions. Governments worldwide are implementing policies that encourage the use of cleaner fuels and additives that minimize environmental impact. This regulatory landscape is likely to drive demand for fuel additives that comply with these standards, as consumers and manufacturers alike seek to adhere to legal requirements. The market for eco-friendly fuel additives is expanding, with many products designed to enhance combustion efficiency and reduce harmful emissions. As a result, the Automotive Aftermarket Fuel Additive Market is expected to evolve, with a growing emphasis on sustainable solutions that align with regulatory frameworks.

Technological Innovations

The Automotive Aftermarket Fuel Additive Market is witnessing a wave of technological innovations that enhance product efficacy. Advances in chemical formulations and application methods are leading to the development of more effective fuel additives. These innovations not only improve fuel efficiency but also address specific engine performance issues, making them attractive to consumers. The introduction of smart additives that can adapt to different driving conditions is also gaining traction. As technology continues to evolve, the Automotive Aftermarket Fuel Additive Market is likely to see an influx of new products that cater to the diverse needs of modern vehicles, thereby expanding market reach and consumer interest.

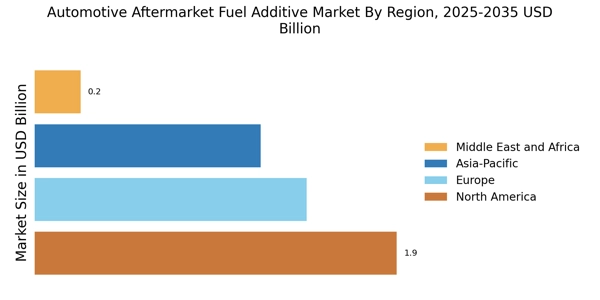

Increased Vehicle Ownership

The Automotive Aftermarket Fuel Additive Market is benefiting from the rising trend of vehicle ownership. As more individuals acquire vehicles, the demand for maintenance products, including fuel additives, is expected to grow. Data suggests that vehicle ownership rates have been steadily increasing, particularly in emerging markets where economic development is fostering a middle class with disposable income. This demographic shift indicates a potential for increased sales in the fuel additive sector, as new vehicle owners often seek to maintain their vehicles' performance and longevity. Moreover, the Automotive Aftermarket Fuel Additive Market may see a diversification of products tailored to various vehicle types, further enhancing market opportunities.

Consumer Awareness and Education

The Automotive Aftermarket Fuel Additive Market is benefiting from increased consumer awareness regarding vehicle maintenance and performance. Educational campaigns and marketing efforts are informing consumers about the advantages of using fuel additives, such as improved engine performance and fuel efficiency. As individuals become more knowledgeable about the benefits of these products, they are more likely to incorporate them into their vehicle maintenance routines. This heightened awareness is expected to drive sales in the Automotive Aftermarket Fuel Additive Market, as consumers actively seek solutions that enhance their driving experience. Furthermore, the trend of sharing information through digital platforms is amplifying the reach of these educational initiatives, potentially leading to a broader customer base.