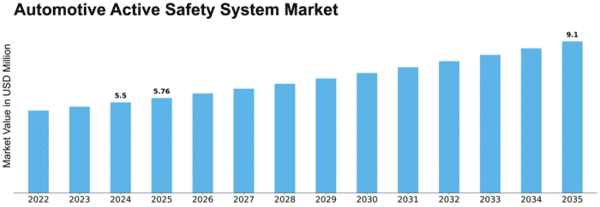

Automotive Active Safety System Size

Automotive Active Safety System Market Growth Projections and Opportunities

The Automotive Active Safety System Market is influenced by various market factors that shape its dynamics and growth trajectory. One of the primary drivers is the increasing concern for road safety among consumers and regulatory bodies worldwide. With a rising number of road accidents and fatalities, governments are enforcing stringent safety regulations, compelling automotive manufacturers to integrate advanced safety systems into their vehicles. This push for safer vehicles has led to a surge in the demand for automotive active safety systems, including features like adaptive cruise control, lane departure warning, and autonomous emergency braking.

Moreover, technological advancements play a pivotal role in driving the market forward. The automotive industry is witnessing rapid technological innovations, particularly in the field of sensor technologies, artificial intelligence, and vehicle-to-vehicle communication systems. These advancements have enabled the development of more sophisticated active safety systems that can accurately detect and respond to potential hazards on the road, thereby enhancing overall vehicle safety.

Another significant market factor is the increasing consumer preference for vehicles equipped with advanced safety features. As awareness about the importance of road safety grows, consumers are becoming more inclined towards vehicles that offer enhanced protection against accidents. This shift in consumer preferences has prompted automakers to prioritize the integration of active safety systems into their vehicles, thereby driving market growth.

Furthermore, the growing trend towards electric and autonomous vehicles is expected to significantly impact the automotive active safety system market. Electric and autonomous vehicles rely heavily on advanced safety technologies to ensure safe operation, thereby creating lucrative opportunities for active safety system manufacturers. As the adoption of electric and autonomous vehicles continues to rise, the demand for advanced safety systems is expected to escalate, further fueling market growth.

On the other hand, there are certain challenges that the automotive active safety system market faces. One such challenge is the high cost associated with these advanced technologies. While active safety systems offer numerous benefits in terms of accident prevention and mitigation, their high cost can deter budget-conscious consumers from opting for vehicles equipped with these features. Additionally, the complexity of integrating and calibrating multiple safety systems within a vehicle can pose technical challenges for automakers, leading to potential implementation issues.

Moreover, the COVID-19 pandemic has also had a significant impact on the automotive industry, including the active safety system market. The temporary shutdown of manufacturing facilities and disruptions in the supply chain have led to production delays and supply shortages, affecting market growth. However, as the automotive industry gradually recovers from the impact of the pandemic, the demand for active safety systems is expected to rebound, driven by the increasing focus on vehicle safety and the resurgence of automotive production.

In conclusion, the automotive active safety system market is influenced by various market factors, including increasing safety regulations, technological advancements, consumer preferences, and the rise of electric and autonomous vehicles. While certain challenges exist, such as high costs and technical complexities, the market is poised for significant growth in the coming years as manufacturers continue to prioritize safety and innovation in vehicle design.

Leave a Comment