Automated Storage and Retrieval System Market Summary

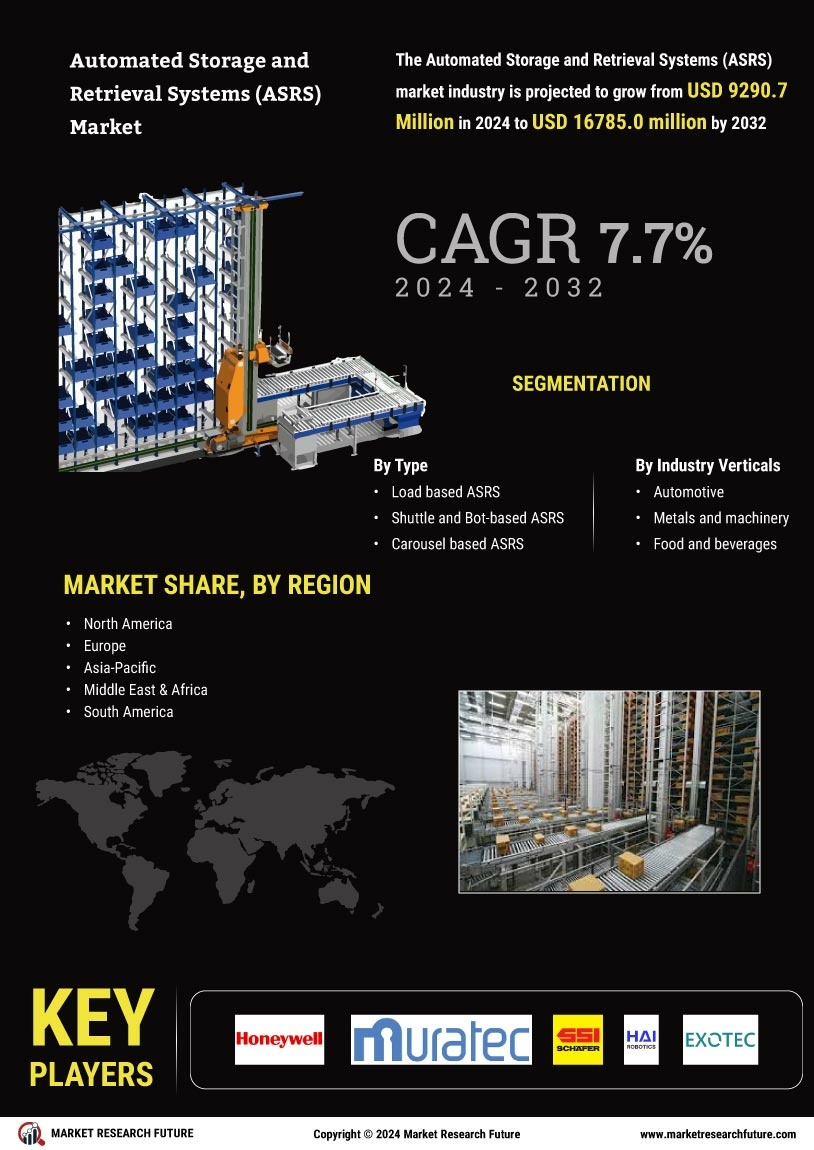

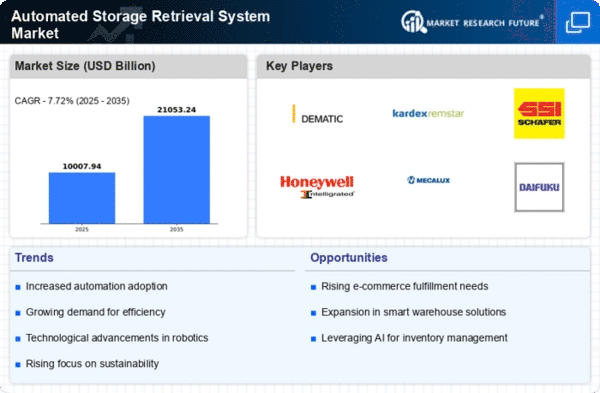

As per Market Research Future analysis, the Automated Storage Retrieval System Market, also referred to as the automated storage retrieval system and asrs automated storage retrieval system, Size was estimated at 9290.7 USD Billion in 2024. The automated storage and retrieval system asrs industry is projected to grow from 10007.96 USD Billion in 2025 to 21053.24 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.72% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Automated Storage Retrieval System Market is experiencing robust growth driven by technological advancements and evolving consumer demands.

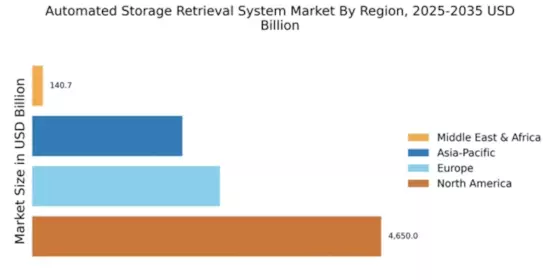

- Technological advancements are enhancing the efficiency and accuracy of automated storage systems, particularly in North America.

- Sustainability initiatives are increasingly influencing market strategies, with companies seeking eco-friendly solutions in the Asia-Pacific region.

- Customization and flexibility are becoming essential as businesses adapt to diverse operational needs, especially in the warehouse management segment.

- The rising demand for efficiency and the challenges posed by labor shortages are significant drivers propelling market growth in both e-commerce and healthcare sectors.

Market Size & Forecast

| 2024 Market Size | 9290.7 (USD Billion) |

| 2035 Market Size | 21053.24 (USD Billion) |

| CAGR (2025 - 2035) | 7.72% |

Major Players

Dematic (US), Kardex Remstar (DE), SSI Schaefer (DE), Honeywell Intelligrated (US), Mecalux (ES), Swisslog (CH), Daifuku (JP), Vanderlande (NL), Schaefer (DE) — representing leading automated storage and retrieval system companies.