Shift Towards Organic Farming

The shift towards organic farming is significantly impacting the automated pest monitoring system Market. As consumers increasingly demand organic produce, farmers are adopting practices that minimize chemical inputs. Automated pest monitoring systems provide an effective means to manage pests in organic farming, allowing for timely interventions without resorting to synthetic pesticides. The organic farming market has been expanding, and this trend is likely to continue, driving the need for innovative monitoring solutions. As farmers seek to maintain crop health while adhering to organic standards, the automated pest monitoring market is poised for growth.

Government Initiatives and Support

Government initiatives aimed at promoting sustainable agricultural practices are contributing to the growth of the Automated Pest Monitoring System Market. Various countries are implementing policies that encourage the adoption of innovative pest management technologies. These initiatives often include funding, subsidies, and research grants to support the development and implementation of automated monitoring systems. As governments prioritize food security and environmental sustainability, the demand for automated pest monitoring solutions is expected to rise. This supportive regulatory environment is likely to foster innovation and investment in the sector.

Increasing Awareness of Pest Resistance

The growing awareness of pest resistance among agricultural stakeholders is influencing the Automated Pest Monitoring System Market. Farmers are becoming increasingly cognizant of the challenges posed by resistant pest populations, which can lead to significant crop losses. This awareness drives the need for effective monitoring systems that can provide insights into pest behavior and population dynamics. As a result, there is a heightened demand for automated solutions that can assist in developing targeted pest management strategies. The market is likely to expand as more stakeholders recognize the importance of proactive pest monitoring in combating resistance.

Rising Demand for Precision Agriculture

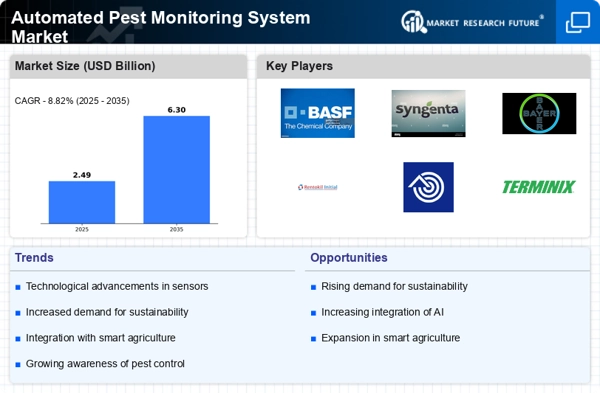

The Automated Pest Monitoring System Market is experiencing a surge in demand due to the increasing adoption of precision agriculture practices. Farmers are increasingly seeking efficient methods to monitor pest populations and minimize crop damage. This trend is driven by the need for sustainable farming solutions that enhance productivity while reducing chemical usage. According to recent data, the precision agriculture market is projected to grow significantly, indicating a parallel growth in the automated pest monitoring sector. As farmers recognize the benefits of real-time data and analytics, the integration of automated systems becomes essential for optimizing pest management strategies.

Technological Advancements in Monitoring Systems

Technological advancements play a pivotal role in the growth of the Automated Pest Monitoring System Market. Innovations such as advanced sensors, drones, and data analytics tools are revolutionizing pest monitoring. These technologies enable farmers to detect pest infestations early, allowing for timely interventions. The market for agricultural drones, for instance, is expected to witness substantial growth, which correlates with the increasing demand for automated monitoring systems. As these technologies become more accessible and affordable, their adoption is likely to accelerate, further propelling the automated pest monitoring market.