Top Industry Leaders in the Automated Passenger Counting System Market

The Competitive Landscape of the Automated Passenger Counting System Market

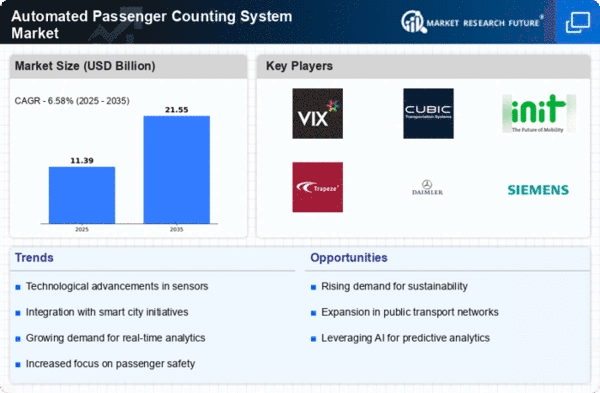

The Automated Passenger Counting System (APC) market, is humming with activity as players jockey for market share. Fueled by the need for efficient public transport management, rising urban populations, and increased focus on data-driven decision-making, the competition is fierce and ever-evolving. Let's delve into the strategies employed by key players, the factors influencing market share, the emergence of new players, and the overall competitive landscape illuminating this dynamic industry.

Some of the Automated Passenger Counting System companies listed below:

- Ris-GmbH

- HELLA Aglaia Mobile Vision

- Eurotech

- DILAX Intelcom

- Infodev Electronic Designers

- Cisco Systems

- Siemens

- Hitachi

- Huawei Technology Co Ltd

- Clever Devices Ltd

Strategies Adopted by Leaders:

- Sensor Fusion: Integrating multiple sensor technologies, such as cameras, LiDAR, and Wi-Fi, is gaining traction. This provides richer data, enabling accurate passenger counts across diverse environments and lighting conditions.

- Data Analytics and Insights: Offering sophisticated data analysis platforms is becoming a key differentiator. Companies are developing systems that not only count passengers but also provide insights into dwell times, passenger distribution, and ridership patterns, allowing for optimized scheduling and resource allocation.

- Cloud-Based Solutions: Moving towards cloud-based platforms is streamlining data storage, analysis, and accessibility. This enables real-time data visualization and centralized management, appealing to transport operators seeking scalability and flexibility.

- Partnerships and Collaborations: Collaboration with public transport authorities, technology companies, and research institutions is fostering innovation and accelerating market penetration. This allows companies to tailor solutions to specific needs and access wider distribution channels.

- Cybersecurity Focus: As data security becomes paramount, companies are prioritizing robust cybersecurity measures to protect passenger data and ensure system integrity. This builds trust and compliance with evolving regulations.

Factors for Market Share Analysis:

- Technology Breadth: Offering a comprehensive range of sensor technologies and data analysis capabilities attracts a broader customer base.

- Regional Reach: Establishing a strong global presence through strategic partnerships and localized solutions is crucial for market dominance.

- Cost-Effectiveness: Balancing advanced features with competitive pricing is essential, particularly in budget-constrained environments.

- System Integration: Seamless integration with existing ticketing systems and operational platforms enhances user experience and increases adoption rates.

- Customization and Scalability: Offering customizable solutions and scalability to cater to diverse needs of different transport modes strengthens market presence.

New and Emerging Companies:

- AI-Powered Analytics: Companies like ZenFi and Camber use AI algorithms to analyze passenger behavior and predict ridership patterns, enabling proactive resource management and improved service delivery.

- Open-Source Solutions: Companies like OpenAPS are offering cost-effective, open-source APC systems, particularly appealing to smaller transport operators and developing nations.

- Focus on Specific Applications: Companies like GateZero focus on niche applications like airport passenger counting, offering specialized solutions tailored to unique needs and regulations.

Latest Company Updates:

February 2023- The German public transport operator Stadtwerke Aschaffenburg Verkehrs GmbH has placed an order for 12 hydrogen buses from Solaris: 10 Urbino 12 hydrogen and 2 Urbino 18 hydrogen models. This is the first order Solaris has received for the 18-meter hydrogen fuel cell buses that were introduced last autumn. The interior of the vehicles will have air conditioning, cameras monitoring the passenger area and surroundings, and an advanced passenger communication system as standard features. An automatic passenger counting system will keep the driver updated on how many passengers are currently on the bus.

April 2023- The Lufthansa Group's airline Swiss will test using artificial intelligence to count passengers as they board flights. From April to June, Swiss will install cameras on certain flights to film people getting on the plane. The video will be used to digitally tally the number of passengers. Swiss says the goal is to reduce the work for cabin crew members and improve safety. The three-month experiment, done with an outside company, intends to train the AI program to learn from watching the boarding process.

June 2022- In June 2022, Cisco announced its plan to build a cloud-based, integrated platform that can secure and connect organizations of all sizes and types. The goal is to create a platform that safeguards the whole IT environment without forcing public cloud lock-in. The Security Cloud will also give a unified experience for securely connecting people and devices globally to apps and data anywhere. With unified management, this open platform will provide threat prevention, detection, response, and correction abilities at scale.