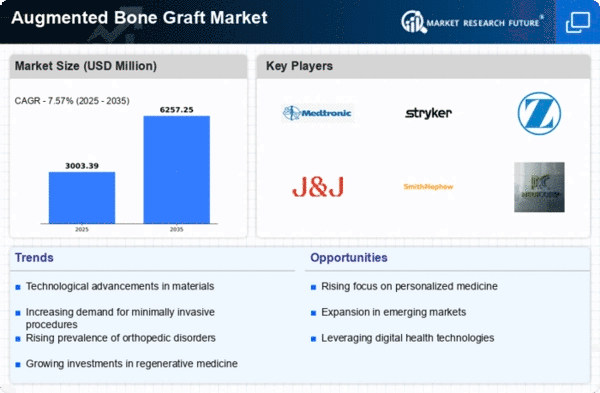

Market Growth Projections

The Global Augmented Bone Graft Market Industry is projected to experience substantial growth over the coming years. With an anticipated market value of 1.54 USD Billion in 2024, the industry is set to expand significantly, potentially reaching 3.58 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.97% from 2025 to 2035. Such projections indicate a robust demand for augmented bone graft products, driven by various factors including technological advancements, increasing healthcare investments, and rising awareness among patients. These metrics underscore the positive outlook for the industry.

Rising Incidence of Bone Disorders

The Global Augmented Bone Graft Market Industry is experiencing growth driven by the increasing prevalence of bone disorders such as osteoporosis and fractures. According to health statistics, the incidence of osteoporosis is projected to rise significantly, particularly among the aging population. This demographic shift is expected to lead to a higher demand for bone grafting procedures, thereby propelling the market forward. The need for effective treatment options for bone-related ailments is paramount, as it directly correlates with the rising number of surgical interventions. Consequently, the Global Augmented Bone Graft Market Industry is poised for expansion as healthcare providers seek innovative solutions to address these challenges.

Growing Awareness and Acceptance of Bone Grafting

There is a notable increase in awareness and acceptance of bone grafting procedures among patients and healthcare providers, which is positively influencing the Global Augmented Bone Graft Market Industry. Educational initiatives and patient advocacy have played a crucial role in demystifying the procedures and highlighting their benefits. As more individuals become informed about the options available for treating bone defects, the demand for augmented bone grafts is likely to rise. This growing acceptance is expected to contribute to a compound annual growth rate of 7.97% from 2025 to 2035, reflecting a robust market outlook.

Technological Advancements in Grafting Techniques

Technological innovations in grafting techniques are playing a pivotal role in shaping the Global Augmented Bone Graft Market Industry. The introduction of advanced materials and methods, such as 3D printing and bioactive scaffolds, enhances the efficacy of bone grafts. These innovations not only improve patient outcomes but also reduce recovery times, making them more appealing to both surgeons and patients. As these technologies continue to evolve, they are likely to drive market growth by offering more effective solutions for bone regeneration. The integration of technology into surgical practices is expected to contribute significantly to the projected market value of 1.54 USD Billion in 2024.

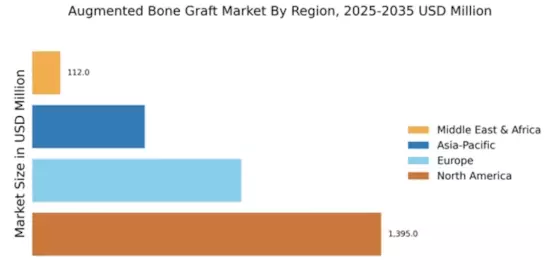

Increasing Investment in Healthcare Infrastructure

The Global Augmented Bone Graft Market Industry is benefiting from increased investment in healthcare infrastructure, particularly in developing regions. Governments and private entities are recognizing the need for improved healthcare facilities and services, which includes the availability of advanced surgical procedures. This investment is likely to enhance access to bone grafting surgeries, thereby driving demand for augmented bone graft products. As healthcare systems expand and modernize, the market is expected to see a surge in the utilization of innovative grafting solutions. This trend aligns with the projected growth trajectory, potentially reaching 3.58 USD Billion by 2035.

Regulatory Support and Approval for Advanced Products

Regulatory bodies are increasingly providing support and expedited approval processes for advanced bone graft products, which is a significant driver for the Global Augmented Bone Graft Market Industry. This regulatory environment fosters innovation and encourages manufacturers to develop new and improved grafting solutions. As a result, the market is likely to see a proliferation of novel products that meet stringent safety and efficacy standards. This supportive regulatory landscape not only enhances product availability but also instills confidence among healthcare providers and patients, further propelling market growth.