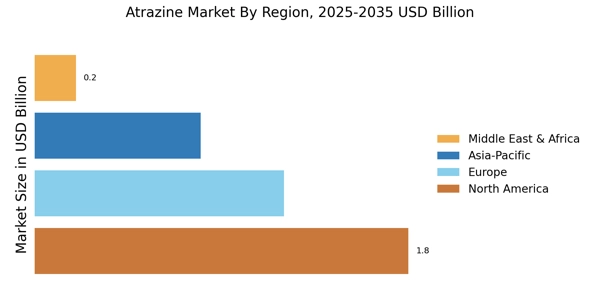

Global Crop Production Trends

The Atrazine Market is closely linked to global crop production trends, particularly in staple crops such as corn and sorghum. As the demand for these crops continues to rise, driven by population growth and changing dietary preferences, the need for effective weed control becomes increasingly critical. In 2025, it is projected that corn production will reach 1.2 billion metric tons, necessitating the use of herbicides like atrazine to ensure optimal yields. This correlation between crop production and herbicide usage suggests that the Atrazine Market will likely experience sustained growth. Additionally, fluctuations in crop prices may influence farmers' decisions regarding herbicide application, further impacting the dynamics of the atrazine market.

Increasing Demand for Herbicides

The Atrazine Market is experiencing a notable surge in demand for herbicides, driven by the need for effective weed management in agricultural practices. As farmers seek to enhance crop yields, the reliance on herbicides like atrazine has intensified. In 2023, the herbicide segment accounted for approximately 30% of the total agrochemical market, indicating a robust growth trajectory. This trend is likely to continue as agricultural productivity becomes paramount in meeting food security challenges. The increasing adoption of atrazine in various crops, particularly corn and sugarcane, further underscores its significance in the Atrazine Market. Moreover, the expansion of arable land in developing regions may contribute to the heightened demand for atrazine, as farmers look for reliable solutions to combat weed competition.

Regulatory Landscape and Compliance

The regulatory environment surrounding the Atrazine Market is evolving, with governments implementing stricter guidelines for pesticide usage. Recent assessments by environmental agencies have led to increased scrutiny of atrazine's environmental impact. In 2025, it is anticipated that new regulations will be introduced, potentially affecting the formulation and application of atrazine. While this may pose challenges for manufacturers, it also presents opportunities for innovation in developing safer and more effective formulations. Companies that proactively adapt to these regulatory changes may gain a competitive edge in the Atrazine Market. Furthermore, compliance with these regulations is likely to enhance consumer confidence, thereby fostering a more sustainable market for atrazine.

Advancements in Application Technologies

Technological innovations in application methods are transforming the Atrazine Market. Precision agriculture techniques, such as drone-assisted spraying and variable rate application, are gaining traction among farmers. These advancements allow for more efficient and targeted use of atrazine, minimizing waste and environmental impact. In 2024, it is projected that the adoption of precision agriculture will increase by 15%, further enhancing the efficacy of atrazine applications. This shift not only optimizes resource utilization but also aligns with the growing emphasis on sustainable farming practices. As farmers become more adept at utilizing these technologies, the Atrazine Market is likely to witness a corresponding rise in atrazine usage, reinforcing its position as a preferred herbicide.

Rising Awareness of Sustainable Agriculture

The Atrazine Market is witnessing a shift towards sustainable agricultural practices, driven by increasing awareness among consumers and farmers alike. As the demand for organic and sustainably produced food rises, farmers are exploring integrated pest management strategies that include the judicious use of atrazine. In 2023, approximately 25% of farmers reported incorporating sustainable practices into their operations, indicating a growing trend. This shift may lead to a more balanced approach to herbicide application, where atrazine is used in conjunction with other methods to minimize environmental impact. The Atrazine Market could benefit from this trend, as farmers seek effective solutions that align with sustainability goals while maintaining productivity.