Rising Prevalence of Asthma

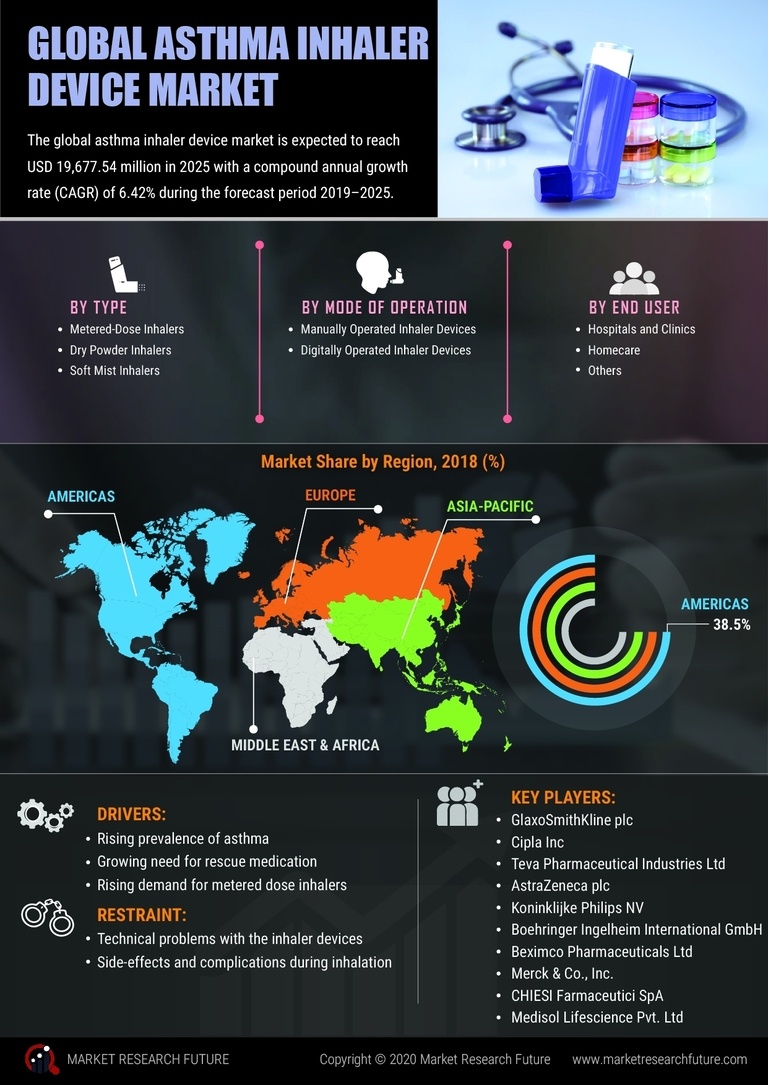

The Asthma Inhaler Device Market is significantly influenced by the rising prevalence of asthma worldwide. Recent statistics indicate that asthma affects approximately 300 million individuals globally, with numbers expected to rise due to environmental factors and lifestyle changes. This increasing patient population necessitates a corresponding rise in the availability and accessibility of inhaler devices. As more individuals seek effective management of their condition, the demand for various inhaler types, including metered-dose inhalers and dry powder inhalers, is likely to escalate. Consequently, this trend underscores the critical role of the Asthma Inhaler Device Market in addressing the needs of a growing demographic of asthma sufferers.

Increased Awareness and Education

The Asthma Inhaler Device Market is benefiting from increased awareness and education surrounding asthma management. Public health campaigns and educational initiatives are playing a pivotal role in informing patients about the importance of proper inhaler use and adherence to prescribed therapies. As awareness grows, patients are more likely to seek out effective inhalation devices, thereby driving market demand. Furthermore, healthcare professionals are increasingly emphasizing the need for patient education, which is likely to enhance the overall effectiveness of asthma management strategies. This heightened focus on education suggests that the Asthma Inhaler Device Market will continue to expand as more patients become informed about their treatment options.

Regulatory Support and Innovation

The Asthma Inhaler Device Market is experiencing a favorable environment due to regulatory support and innovation. Regulatory bodies are increasingly recognizing the importance of asthma management and are streamlining the approval processes for new inhaler devices. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of innovative products that meet evolving patient needs. As a result, the market is likely to witness a surge in novel inhaler technologies that enhance usability and effectiveness. This trend indicates that the Asthma Inhaler Device Market is poised for growth as regulatory frameworks adapt to support advancements in inhaler technology.

Growing Demand for Personalized Medicine

The Asthma Inhaler Device Market is also being shaped by the growing demand for personalized medicine. Patients are increasingly seeking tailored treatment options that cater to their specific needs and preferences. This shift towards personalized healthcare is prompting manufacturers to develop inhaler devices that can be customized based on individual patient profiles. Such innovations may include dose adjustments and device features that align with patient lifestyles. As the healthcare landscape evolves, the Asthma Inhaler Device Market is likely to expand in response to this demand for personalized solutions, ultimately enhancing patient satisfaction and treatment outcomes.

Technological Advancements in Inhaler Design

The Asthma Inhaler Device Market is experiencing a notable transformation due to technological advancements in inhaler design. Innovations such as smart inhalers, which integrate digital health technologies, are becoming increasingly prevalent. These devices not only track medication usage but also provide real-time feedback to patients and healthcare providers. The incorporation of sensors and mobile applications enhances adherence to treatment regimens, potentially improving patient outcomes. According to recent data, the market for smart inhalers is projected to grow significantly, indicating a shift towards more sophisticated inhalation devices. This trend suggests that as technology continues to evolve, the Asthma Inhaler Device Market will likely see a surge in demand for these advanced solutions.